-

March 11, 2025

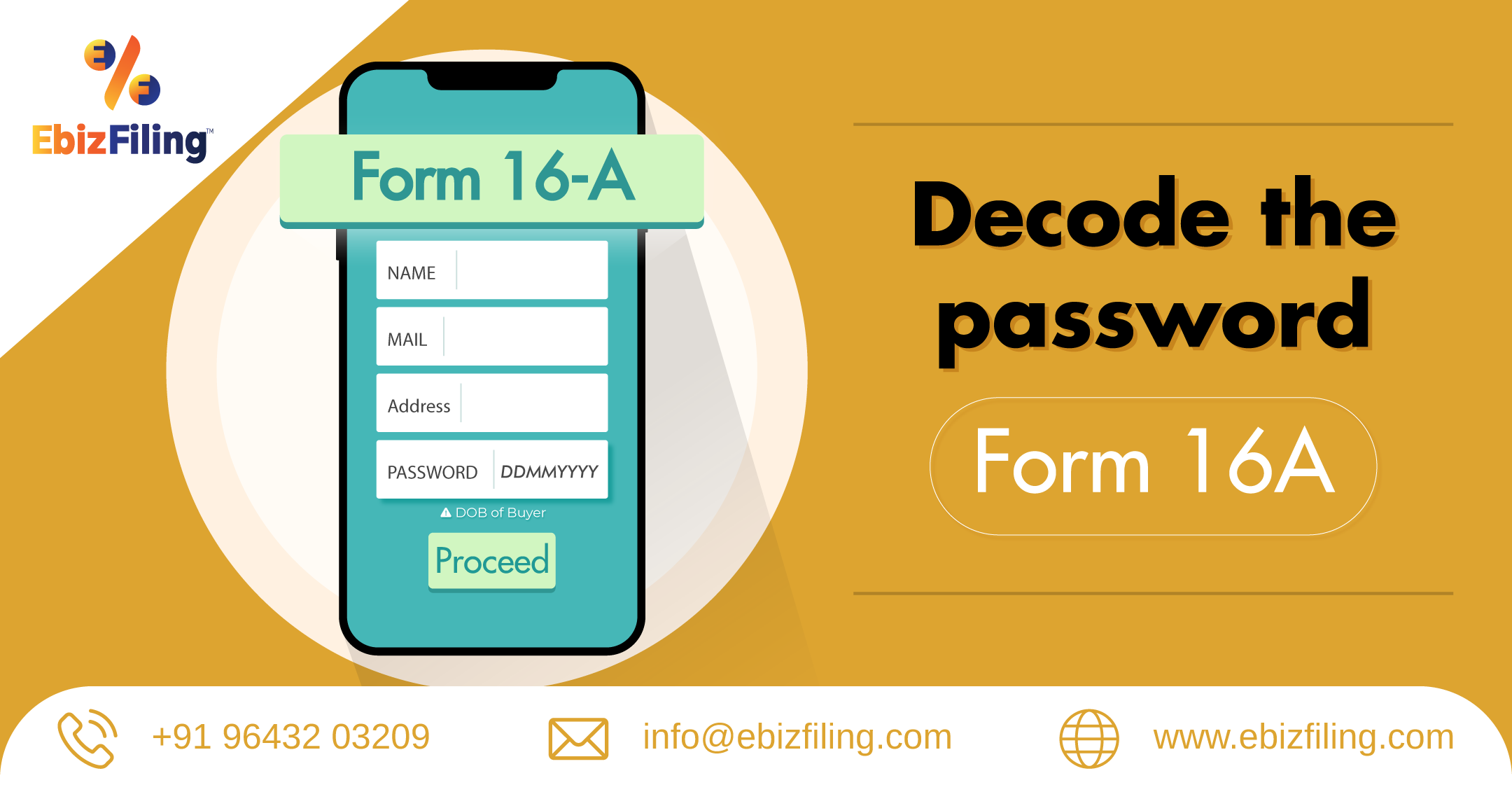

Decode the Password for Form 16A- for TDS deducted on income other than salary

What is Form 16A?

Form 16A is a TDS certificate issued by the Income Tax Department of India. It provides details of tax deducted at source on income like interest, rent, commission, or professional fees. It is essential for filing tax returns. Please note that the form 16A password is not applicable as it does not require a password for access.

- It is an acknowledgement receipt that states the tax that has been deducted from income other than salary by the employer and the same has been deposited with the Income Tax Department.

- Form 16A, just like Form 16 is a TDS certificate.

- Form 16A is issued when the TDS deduction is made for the income of fixed deposits in the bank or TDS deducted on insurance commission, TDS deducted on your rent receipts etc.

- Hence, Form 16A is issued when TDS is deducted on any other income you receive that is liable for such deduction.

- Form 16A, just like Form 16 contains the details of deductor and deductee, like name and address, details of PAN and TAN, also the amount of TDS deducted and deposited with the government.

- All details that are there in Form 16A are available on Form 26AS.

How to get Form 16A- TDS on income other than salary?

- It is mandatory for the person who deducts the TDS to issue TDS certificate in form 16A to the deductee.

- Form 16A can be downloaded from TRACES website. Once the deductor furnishes the details in Form 26AS and deposits the TDS, he or she can download Form 16A online.

What is the Form 16A password?

- Form 16A is always password protected.

- The password for the Form 16A would be the first 5 characters of the PAN number in uppercase i.e. capital letters and Date of Birth of the employee in DDMMYYYY format.

- That means if your PAN number is BPTRA5997L and the date of birth is 11th November, 2000, then your password for Form 16A would be BPTRA11112000.

Form 16A is important as this form helps the taxpayers in filing their return smoothly. Form 16A also helps in verifying the income details and also the rate at which the TDS has been deducted. To avoid any sort of inconstancy when it comes to filing taxes, it is mandatory for the taxpayers to find out details about Form 16 and other Forms and use them accordingly.

Suggested Read :

Monthly GST Return Filing Due Date

TDS Return

File TDS return with Ebizfiling at affordable prices with Ebizfiling

About Ebizfiling -

Reviews

Ajit Gopal Pandit

20 Feb 2018Very efficient service to get yourself registered with your Business. Had a very good experience.

Deepika Khan

29 Sep 2018I would rate 5/5 for their services, pricing and transparency.

Janvi Seth

14 May 2018I wanted to register my business on E-commerce and my colleague suggested me Ebizfiling. I am glad we made the right choice of choosing them.

June 17, 2025 By Team Ebizfiling

Renewal of 12A and 80G Registration Introduction In India, charitable and not-for-profit organizations such as trusts, societies, and NGOs can apply for income tax exemptions and donor benefits under Sections 12A and 80G of the Income Tax Act, 1961. These […]

June 17, 2025 By Team Ebizfiling

80G donation limit for salaried person Introduction When it comes to saving tax, charitable donations can be a powerful tool. The Indian Income Tax Act provides several provisions to encourage taxpayers to contribute to charitable causes. One of the most […]

June 17, 2025 By Team Ebizfiling

Section 80GG deduction under Income tax act Introduction In India, the cost of living, especially rent, can be a significant portion of an individual’s monthly expenses, particularly for those residing in metro cities. While salaried individuals receiving House Rent Allowance […]