-

Articles - Company Law

-

April 15, 2024 By Team Ebizfiling

What differentiates business permits from a business license?What differentiates business permits from a business license? It can frequently feel like figuring out a complicated code to navigate the legal requirements. The terms “business license” and “business permits” frequently come up among the various regulations and documentation. While […]

- A Guide to Renew a Trust License in India

- What is a ROC search report?

- બોર્ડનો ઠરાવ કેવી રીતે તૈયાર કરવો અને પાસ કરવો

- Ideal employee benefits followed by employers in India

-

-

Articles - Company Law

-

April 15, 2024 By Team Ebizfiling

Travel Agency Registration Online: Legal Requirements to start a business Made SimpleTravel Agency Registration Online: Legal requirements to start a business made simple Do you also dream about how to start a travel agency in India? Pretty exciting, right?? Imagine yourself assisting others in organizing their ideal getaways, visiting far-off places, […]

- Understanding Leave Policies in India: A Guide for Employers

- Statutory Compliance: A Checklist for Pvt Ltd Company Compliance

- A guide on Compulsory Share Transfer Provision

- How to Register Charges on Intangible Assets?

-

-

Articles - Company Law

-

April 13, 2024 By Team Ebizfiling

A Comprehensive Guide to Export License Requirements for Medical Devices and PharmaceuticalsExport License Requirements for Medical Devices and Pharmaceuticals Complying with export licensing standards is critical for the pharmaceutical and medical device industry across the globe. This complicated procedure facilitates global trade while guaranteeing regulatory compliance. Businesses looking to grow internationally […]

- Difference between Government Company and Public Limited Company

- Legal Consequences of Strike Off OPC

- Benefits of Increasing Authorized Capital

- Audit Trail for Accounting Software

-

-

Articles - Company Law

-

April 13, 2024 By Team Ebizfiling

The Pros and Cons of Online vs. Traditional Business License ApplicationOnline vs. Traditional Business License Application: Pros and Cons Because online platforms are so convenient, starting a business in the digital age has never been easier. Getting the required permits and registrations is an important stage in this process. This […]

- All About Family Business Dissolution

- What Are The Recent Changes in Form INC 20A?

- How to change a Director of a Company in India?

- Responsibilities of an Independent Director of a Company

-

-

Articles - Company Law

-

April 13, 2024 By Team Ebizfiling

ROC Registration Simplified for Small BusinessROC Registration Simplified for Small Businesses Every economy needs small businesses to function properly since they are the primary sources of innovation, job creation, and economic expansion. Unfortunately, small business owners sometimes underestimate the significance of regulatory compliance amid the […]

- Scope of the Accounting System

- Tips to Minimize Pvt Ltd Company Registration Govt. Fees

- What are the Advantages of a Producer company

- Important aspects to Consider on how to Start an LLC Company for Non-US Residents

-

-

Articles - Company Law

-

April 13, 2024 By Team Ebizfiling

How Can I launch a Business from Home?How Can I Launch a Business from Home? As long as it’s done correctly, launching and maintaining your own business can be an extremely fulfilling and exciting endeavor. People who wish to launch businesses from home frequently forget to obtain […]

- Managing Corporate Compliance: Essential Tips after LLC Company Registration from India

- Employee State Insurance Rate for the year 2023

- What are the Benefits of Name Reservation?

- How to change a Director of a Company in India?

-

Popular Posts

-

June 19, 2023 By Pallavi Dadhich - Articles, Company law

What is the Role of Corporate Governance in Charge creation by Company?All you need to know about the Role of Corporate Governance in Charge creation by Company Introduction Charge creation is a vital aspect of corporate governance that plays a significant role in the functioning of a company. It refers to […]

-

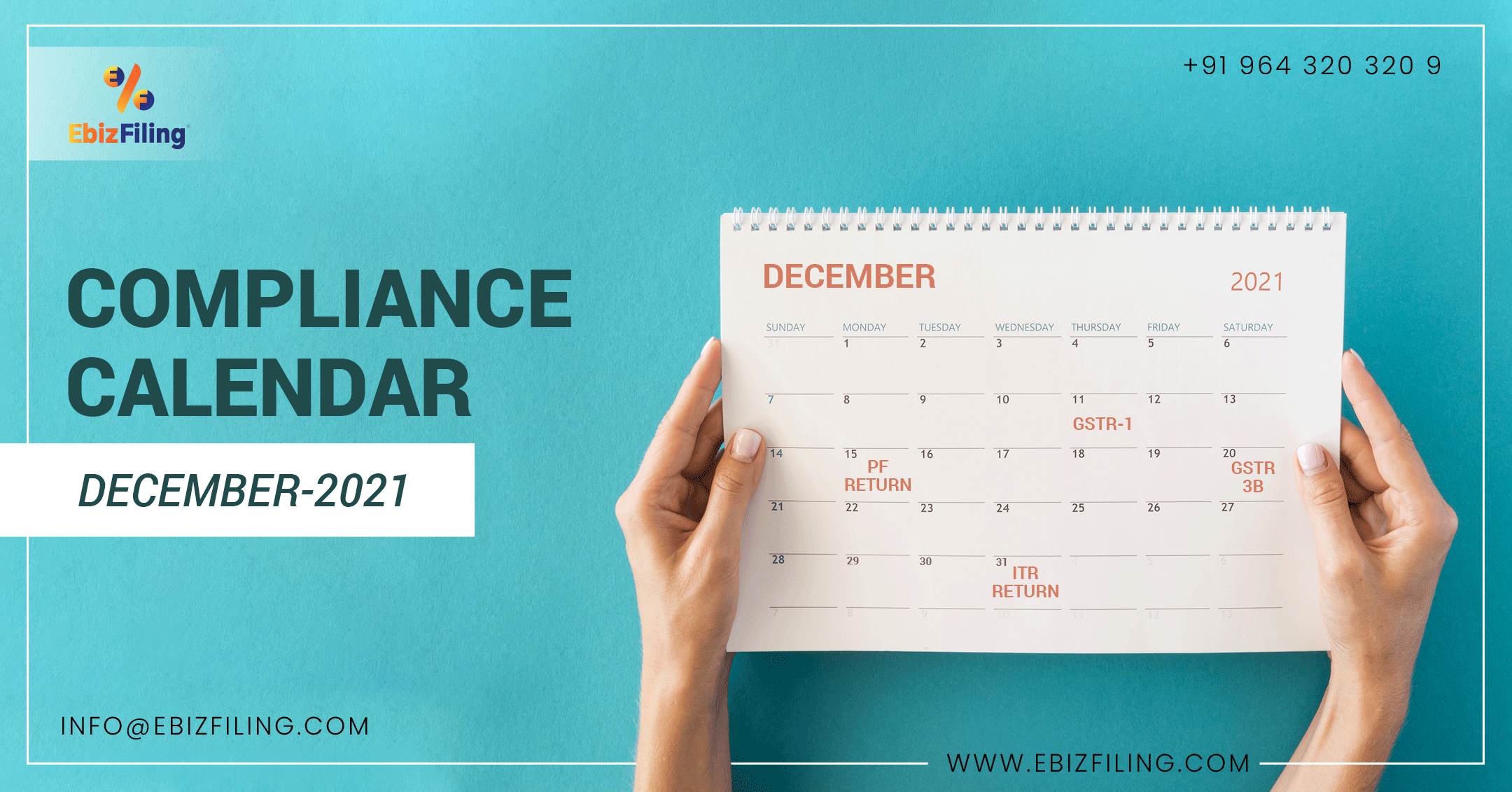

December 30, 2021 By Dharti Popat - Company law, GST, Income tax

Tax Compliance and Statutory due dates for the month of December, 2021Compliance Calendar for the month of December 2021 Starting, owning, or doing a business in India comes with important compliance that a business irrespective of its structure, has to adhere to during a financial year. Be it filing of Income […]

-

October 30, 2021 By Dharti Popat - Articles - Company Law, Articles - GST, Articles - Income Tax, One Person Company

Tax Compliance and Statutory due dates for the month of November, 2021Compliance Calendar for the month of November 2021 Statutory Compliance are part and parcel of a Business. Whatever the business structure be, it is important to comply with all the necessary filings before the due dates. Starting from filing Income […]

About Ebizfiling -