-

December 30, 2021

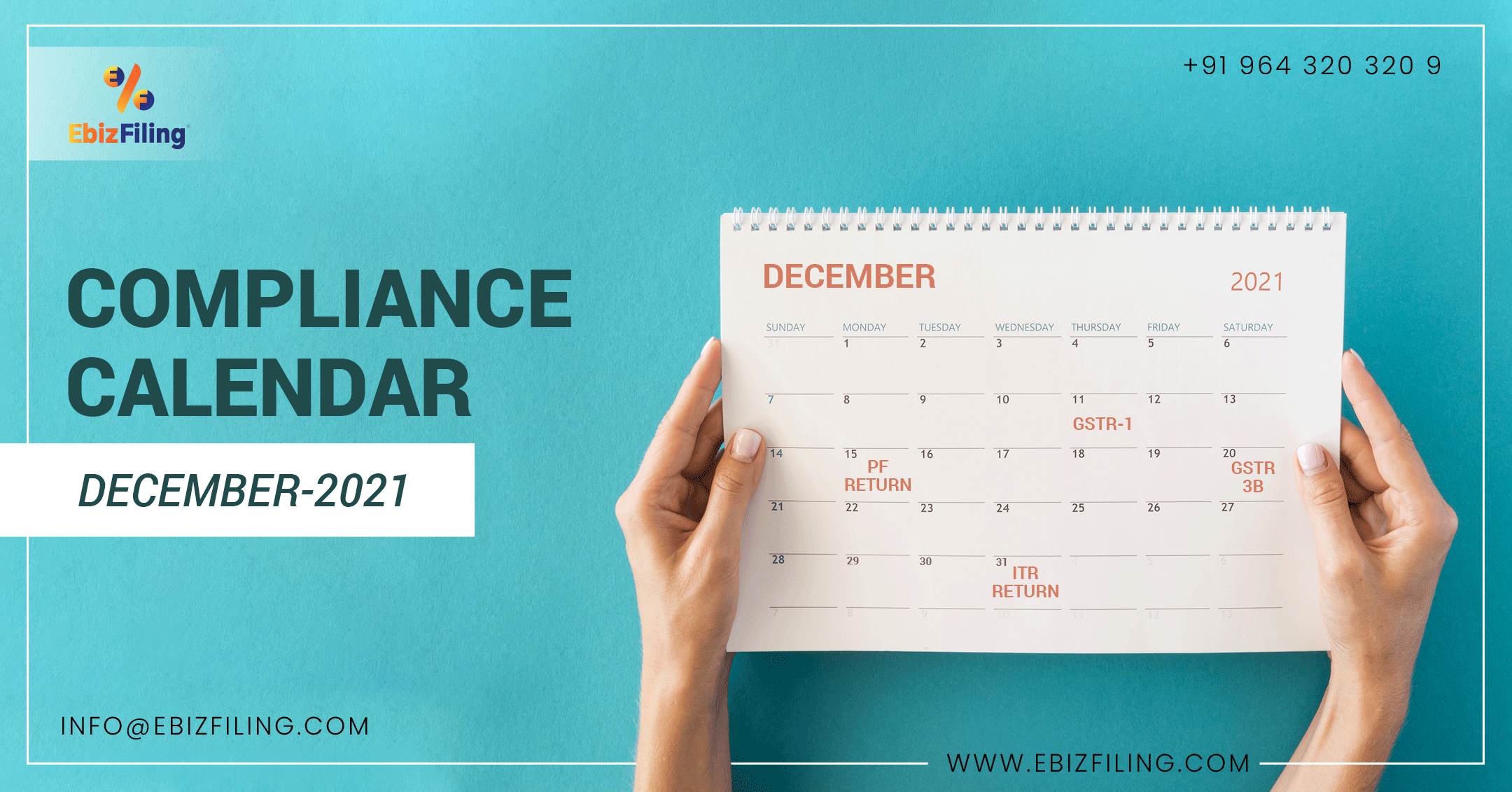

Compliance Calendar for the month of December 2021

Starting, owning, or doing a business in India comes with important compliance that a business irrespective of its structure, has to adhere to during a financial year. Be it filing of Income Tax Return or GST Return or complying with the ROC Annual filing, a business has to keep a close watch over the deadlines of all the mentioned compliance. Each month of the year is important as far as Statutory Compliance and Tax Compliance are concerned, however, this year the month of December 2021 is more important as many statutory due dates for Income Tax Return Filing and ROC Annual Filing have been extended and falling in December 2021. Here is a calendar for various tax and Statutory due dates relating to ROC filing, OPC Annual Filing, GST Return Filing, and Income Tax Filing falling in the Month of December 2021.

Table of Content

Important Update for filing ROC Form MGT 7/MGT 7A and GSTR 9/GSTR 9C

Keeping in view of various requests received from various stakeholders, the MCA has granted the relaxation on levy of additional fees for Annual Financial Statement filings required to be done for the Financial Year 2021-22. The Ministry of Corporate Affairs has extended the due date for filing of e-forms AOC 4, AOC 4(CFS), AOC 4 XBRL, AOC 4 Non-XBRL, is extended till 15.02.2022 and MGT 7/MGT 7A for the Financial Year 2021-22 till 28.02.2022. GSTR 9 and GSTR 9C due date is extended for FY 2021-22 from 31.12.2021 to 28.02.2022. GSTR 9 and GSTR 9C due date is extended till 28.02.2022 from 30.12.2021

Also, on the basis of the various requests received, the CBDT has announced the extension in the due dates for Income Tax filing. Hence, for the Financial Year 2020-21, the last date for filing Income Tax Returns (Non-Audit Cases) has been extended till 31st December 2021 from 31st July 2021 and if Tax Audit is required then the due date for IT Returns has been extended to 15th February 2022 from 30th September 2021.

Compliance Calendar for the Month of December 2021

Important due dates for the GST Returns in the Month of December 2021 |

|||

|

Due date |

Form to be filed |

Period |

Who should file? |

|

10.12.2021 |

GSTR 7 |

November 2021 |

GSTR 7 is a return to be filed by the persons who are required to deduct TDS (Tax deducted at source) under GST |

|

10.12.2021 |

GSTR 8 |

November 2021 |

GSTR-8 is a return to be filed by the e-commerce operators who are required to deduct TCS (Tax collected at source) under GST |

|

11.12.2021 |

November 2021 |

Taxpayers have an aggregate turnover of more than Rs. 5 Crores or opted to file Monthly Return |

|

|

13.12.2021 |

GSTR 1 (IFF) |

November 2021

|

GST return for the taxpayers who opted for QRMP scheme (Optional) |

|

13.12.2021 |

GSTR 6 |

November 2021 |

Input Service Distributors |

|

20.12.2021 |

GSTR 5 & 5A |

November 2021 |

Non-Resident Taxpayers and ODIAR services provider |

|

20.12.2021 |

GSTR 3B |

November 2021 |

The due date for GSTR-3B having an Annual Turnover of more than 5 Crores |

|

25.12.2021 |

GST Challan Payment |

November 2021 |

GST Challan Payment if no sufficient ITC for September (for all Quarterly Filers) |

|

31.12.2021 |

GSTR 9 |

FY 2020-21 |

GST Annual Return |

|

31.12.2021 |

GSTR 9C |

FY 2020-21 |

Statement of Reconciliation under GST |

Important due dates for the Income Tax Compliance / PF / ESI in the Month of December 2021 |

|||

|

07.12.2021 |

Challan No. ITNS- 281 |

November 2021 |

Payment of TDS/TCS deducted /collected in November 2021. |

|

15.12.2021 |

Advance tax |

FY 2021-22 |

3rd installment of advance tax for the assessment year 2022-23 |

|

15.12.2021 |

October 2021 |

The due date for the issue of the TDS Certificate for tax deducted under Section 194IA in the month of October 2021 |

|

|

15.12.2021 |

TDS Certificate |

October 2021 |

The due date for the issue of the TDS Certificate for tax deducted under Section 194IB in the month of September 2021 |

|

15.12.2021 |

TDS Certificate |

October 2021 |

The due date for the issue of the TDS Certificate for tax deducted under Section 194M in the month of September 2021 |

|

15.12.2021 |

Form 24G by Government officer |

November 2021 |

The due date for furnishing of Form 24G by an office of the Government where TDS/TCS for the month of November 2021 has been paid without the production of a challan |

|

15.12.2021 |

Form No. 3BB |

November 2021 |

The due date for furnishing statement in Form no. 3BB by a stock exchange in respect of transactions in which client codes have been modified after registering in the system for the month of November 2021 |

|

15.12.2021 |

Electronic Challan cum Return (ECR) (PF) |

November 2021 |

E-payment of Provident Fund |

|

15.12.2021 |

ESI Challan |

November 2021 |

ESI payment |

|

30.12.2021 |

TDS Challan-cum-statement |

November 2021 |

The due date for furnishing of challan-cum-statement in respect of tax deducted under section 194-IA, 194 IB, 194M |

|

30.12.2021 |

Form No. 3CEAD |

Accounting Year Jan 2020 to Dec 2020 |

Report by a constituent entity, resident in India, in respect of the international group of which it is a constituent if the parent entity is not obliged to file a report under section 286(2) or the parent entity is resident of a country with which India does not have an agreement for the exchange of the report, etc. |

|

31.12.2021 (Extended from 30.09.2021) |

AY 2021-22

|

ITR filing for non-audit cases and who have not entered into any international or specified domestic transactions

|

|

|

31.12.2021 (Extended from 30.11.2021) |

Income Tax Return (Section 92E) |

AY 2021-22 |

Return of income for the assessment year 2021-22 in the case of an assessee if he/it is required to submit a report under section 92E pertaining to the international or specified domestic transaction(s) |

|

31.12.2021 (Extended from 31.08.2021) |

Equalization Levy statement |

FY 2020-21 |

Furnishing of Equalization Levy statement for the Financial Year 2020-21 |

|

31.12.2021 (Extended from 30.11.2021) |

Form No 3CEAC |

– |

Intimation (required to be made on or before 30-11-2021) by a constituent entity, resident in India, of an international group, the parent entity of which is not resident in India in Form 3CEAC |

|

31.12.2021 (Extended from 30.11.2021) |

Form No 3CEAD |

– |

Report by a parent entity or an alternate reporting entity or any other constituent entity, resident in India, which is required to be furnished on or before 30-11-2021, in Form no. 3CEAD |

|

31.12.2021 (Extended from 30.11.2021) |

Form No CEAE |

– |

Intimation on behalf of an international group, which is required to be made on or before 30-11-2021, in Form no. 3CEAE |

|

31.12.2021 (Extended from 15.10.2021) |

Form No. 10BBB |

July to September 2021 |

Intimation in Form 10BBB by a pension fund in respect of each investment made in India for the quarter ending September 2021 |

|

31.12.2021 (Extended from 31.10.2021) |

Form II |

July to September 2021 |

Intimation in Form II by Sovereign Wealth Fund in respect of investment made in India for the quarter ending September 2021 |

|

31.12.2021 (Extended from 15.10.2021) |

Form No. 15CC |

July to September 2021 |

Quarterly statement in respect of foreign remittances (to be furnished by authorized dealers) in Form No. 15CC for the quarter ending September 2021 |

|

31.12.2021 (Extended from 15.10.2021) |

Form No. 15G/15H |

July to September 2021 |

Upload the declarations received from recipients in Form No. 15G/15H during the quarter ending September 2021 |

Important due dates for Company Annual Filing in the Month of December 2021 |

|||

|

14.12.2021 |

Form ADT 1 |

FY 2020-21 |

Form ADT 1 filing by Companies |

|

31.12.2021

|

Form AOC 4 (CFS, XBRL, Non-XBRL) |

FY 2020-21 |

Form AOC 4 filing by Companies |

|

31.12.2021 |

Form MGT 7/ 7A |

FY 2020-21 |

Form MGT 7A filing by One Person Company |

The month of December 2021 is significant for the due dates for various compliances under the Goods and Service Act, Income Tax Act, Companies Act, and LLP Act. Filing the above-mentioned forms on or before the due dates will save the Taxpayers from hefty penalties.

Company Annual Filing

Every Private Limited Company must file returns on an annual basis. Make your company ROC compliant.

About Ebizfiling -

Reviews

Anaita Mehra

19 Jun 2018I am glad I came across Ebizfiling. They helped me through my Patent procedure and I must say it was quick and hassle-free. Definitely recommended!

DEEPAK BAGRA

08 Sep 2018I find the service, working approach and commitments very professional. Their progress updates are commendable. I really liked working with them.

Hemanshu Mahajan

01 Apr 2018I registered my LLP company, from eBizfilling. Great team and very competitive pricing. Will definitely use their services again.Thanks for work well done.

March 9, 2024 By Siddhi Jain

Important Statutory Due Dates For OPC Annual Filing For FY 2023-24 An OPC, or One Person Company, is a company with a single member. Unlike Private Limited or Limited Liability Partnerships, OPCs have fewer compliance requirements. However, it is crucial […]

March 16, 2024 By Siddhi Jain

A compilation of all the ROC (Company) Filing Due dates for Financial Year 2022-23 (AY 2023-24) Indian companies are required to keep track of important due dates for their annual filings at the start of each financial year. This applies […]

March 8, 2024 By Siddhi Jain

Section 194B of Income Tax Act, 1961: Prize, Betting, Lottery Winning Tax Introduction In the present day, there is a wide range of game shows, including the popular Kaun Banega Crorepati (KBC) and Fear Factor, as well as reality shows […]