-

December 28, 2020

Software based ITR filing V/S ITR filing by consultant- What is advisable and why?

Income Tax Return

Filing Income Tax Return is an important task and a duty which needs the utmost precision and care. Especially when there are different forms for different category of taxpayers. The process of Income Tax Return filing can be a nightmare when there are capital gains, stock options, rent, previous losses to carry forward and other details. In today’s world, when everything is shifting to digital and online platforms “Income Tax Return filing” is no exception to this. There are many online portals that give facility for taxpayers to file their IT Return online on their own. Many people are choosing such online portal to file their tax returns, while many others, considering the difficulties usually meet an Income tax consultant or a chartered accountant to help process their tax returns.

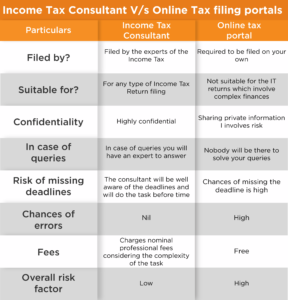

In this article we have put up a safe comparison between the two methods of Tax Return Filing namely, Free online portal V/s Income Tax Consultant.

Income Tax filing- Online free Income Tax Return filing portal V/s Income Tax Consultant

There are more than a few benefits to the electronic route for tax filing, including the fact that it’s free and you’ll have a faster refund turnaround time. But there are some disadvantages, as well, particularly for some taxpayers.

There are many reasons why it is always advisable to choose a professional and expert Income Tax Consultant over an online portal. :

Expertise knowledge

Many individuals lack the knowledge of different kinds of income that need to be reported on the ITR and while filing Income Tax Return online on your own, if you do not know the kind of income, that might be a problem and you may end up filing wrong Tax Return.

While if you choose an Income Tax Consultant, you do not need to worry about anything. The tax consultant is an expert at what they do i.e. Income Tax Filing. They know which income falls under which head. So it is always advisable to hire a consultant.

Simplicity of the task v/s Complexity of the filing:

Filing your own returns is easy if you only have salaried income and interest on bank deposits. but when the tax return filing involves much complexity or difficulties, the process can quickly turn daunting if you have capital gains, stock options, rent, previous losses to carry forward and other details. In such case it would be wise to choose a tax filing expert rather than struggling on your own.

Risk of sharing Information

Income Tax Return filing require to share your personal information. Filing your Income Tax on online portal, too requires your private information. Sharing your private information to an intermediary without any consideration has its risks.

Not only this but the portal may use your information to cross sell other products such as mutual funds or insurance, under the guise of ‘saving tax’. Whereas your private information is safe with the tax consultant and there would be no hammering for any kind of cross selling.

Worry of Deadlines

When you are filing your own Tax Return online you need to be aware of the deadlines and due dates of the filing the tax return. but when you choose an Income Tax Expert, all you have to do is pay the fees, sit back and relax. It would be the consultant’s headache to remember the due date for the IT Return filing.

Suggested Read: How to verify / E-verify your IT Return?

Why Ebizfiling as your Income Tax Filing partner?

- Ebizfiling consists of the highly qualified professional such as Chartered Accountants and the experts of the Accounts.

- Ebizfiling can be your one stop destination for IT Return filing.

- Your Tax Return filing process will be seamless and hassle free.

- As your tax filing will be done by highly qualified experts, there will be no chances of errors. Also, before filing the return, it will be sent to you for verification.

- A reminder through SMS and Email will be sent to you before the due date of Income Tax Return filing.

- Ebizfiling is a professional platform that believes in confidentiality of the client.

- Your work will be done well in advance and with the utmost precision.

- The fees charged by the Ebizfiling is very much affordable.

- At every step you will be made aware with the progress of your Income Tax Return filing process.

Income Tax return

File your Income Tax Return with Ebizfiling.com at affordable prices.

About Ebizfiling -

2 thoughts on “Income Tax Return Filing- Free online portal V/s Income Tax Consultant- Choose wisely.”

Leave a Reply

Reviews

-

“Quite impressed with the professionalism and efficiency that ebiz- filing have demonstrated throughout! Everything runs like clockwork. This means that I can concentrate on building my profession and not be worrying about compliance requirements, the team takes care of it all. Excellent work!!"

-

It is a very professional set up and a really dedicated team. You guys did a great job for my Trademark application in a really short time. All the best to you and your team.

Hi

I need to file ITR for 2019, 2020, 2021

Can you please help? I am ready to bear the penalties but need them filed.

Hi Moumita Ray,

Thank you for your inquiry!

The team will get in touch with you soon. Meanwhile, you can get in touch with Ebizfiling on +919643203209 / info@ebizfiling.com