-

June 2, 2022

How to file Form 15 CA and Form 15 CB?

During business, it happens that many payments are made outside India. When payments are made outside India, there is certain compliance that one needs to follow and tax is required to be deducted for any sum which is taxable under the Income Tax Act. The purpose of this compliance is to collect information in respect of the payments that are chargeable to tax in the hands of recipient NRI. The main requirement is to file Form 15CA and Form 15CB for any payment made outside India to an NRI. Form 15 CA accompanied by Form 15 CB needs to be filed online on official website of Income Tax department.

Table of Content

What is Form 15CA?

Form 15CA is a declaration made by the person remitting the money wherein he states that he has deducted the tax from any payments so made to the non-resident. Form 15 CA needs to be filed by the remitter- a person making the payment to an NRI or a Foreign Company. It is also used as a tool to gather information regarding the payments that are chargeable to tax.

Through form 15 CA, the Income Tax Department also keeps a track of all the foreign remittances/payments and their taxability. As per Income Tax Rule 37BB, it is the responsibility and the duty of authorized banks or dealers to ensure that they obtain such forms from a remitter. Income Tax Form 15 CA is required to be filed online with the Income Tax Department. Also, along with Form 15 CA, 15 CB needs to be filed with the Income-tax Department. However, Form 15 CB needs to be accompanied by a certificate from an Accountant in Form 15CB.

What is Form 15 CB?

While Form 15 CA is a declaration, Form 15 CB is a certificate to be issued by the Chartered Accountant. The Chartered Accountant has to ensure that all the provisions of the Income Tax Act and Double Taxation Avoidance Agreement have been complied with in respect of tax deductions at the time of making the payments.

Applicability of Form 15CA and Form 15CB

- If the amount of remittance is not chargeable to tax, then no forms are required.

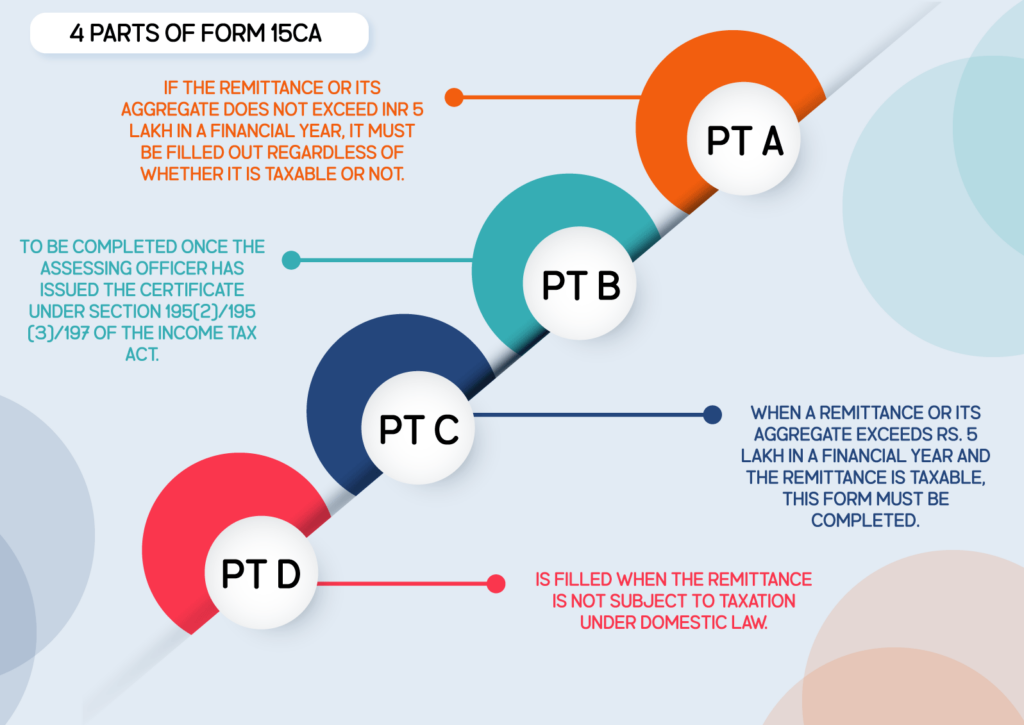

- If the remittance is covered under a specified exemption list, then only Part D of the Form 15CA is to be submitted.

- Where remittance is less than Rs. 5 lakh in a particular financial year – Only Form 15CA – Part A to be submitted.

- Where remittance exceeds Rs. 5 lakh – Form 15CA – Part C and Form 15CB to be submitted.

- Where remittance exceeds Rs. 5 lakhs and a certificate under Section 195(2)/195 (3)/197 of the Income Tax has been obtained – Form 15CA – Part B to be submitted.

Re-designed Form 15 CA and Form 15 CB submission Process

The IT Department has launched a new re-designed submission process for Form 15 CA and Form 15 CB. The decision has been taken based on the various feedbacks of the corporates and professionals across India. It is believed that these changes shall will simplify all the entire Form 15 CA and Form 15 CB filing cycle from preparation of the Forms to assignment to submission to verification process. Let’s have a look at the significant changes in the process.

- For multiple filing of Form 15CA/CB, now it is not mandatory or required to assign the same CA in a particular Financial Year.

- Hence, the Appointment of a Chartered Accountant for Form 15 CB is a one-time activity for a particular Financial Year.

- A CA now can proceed with Form 15 CB for both remittee & remitter without requiring the taxpayer to fill the Part C of Form 15 CA and assign it to the Chartered Accountant, once the single assignment is done in a year. Hence, here the previous process of multiple acceptance and rejection for every form is removed that simplifying the entire process.

- The Chartered Accountant can now access Form 15CB directly from IT Forms functionality for filing instead of Work list for the Action.

- Offline/Bulk Mode of the submission process is enabled since 4th Oct. The taxpayer can generate XML files using the Java-based Offline Utility. The Offline Utilities are available on the portal in the “Download” section under the “Income-tax Forms” page and upload the same in the portal for onward filings. The new online process will follow soon on the portal.

FAQs on Form 15CA and 15CB

1. Is it necessary to file Form 15CB?

No, submitting Form 15CB is not required. Form 15CB is an event-based form that must be completed only when the remittance amount exceeds Rs.5 lakh in a financial year and an accountant certificate is required under Section 288 of the Income Tax Act, 1961.

2. Who needs to fill out Form 15CA?

Any person who is not a company and is responsible for paying a non-resident or a foreign firm must provide the appropriate information on Form 15CA.

3. Who is eligible to utilise Form 15CB?

A Chartered Accountant (CA) registered on the e-Filing platform submits and accesses Form 15CB. To be able to certify the details in Form 15CB, the taxpayer must assign Form 15CA to the CA.

4. What method should be used to verify Form 15CB?

Only the Digital Signature Certificate can be used to e-verify the Form 15CB (DSC). The CA’s DSC must be entered into the e-Filing site. The deadline for submitting Form 15CB is not specified. However, it must be submitted prior to the remittance.

Conclusion

The process of filing of form 15 CA and 15 CB, if understood properly is nor as complicated and tedious as it seems. On the top of it, the simplifications in the process introduced by the Income Tax Department makes it more easier for the taxpayer to follow the procedures. Moreover, it also provides with the option of withdrawing the form 15 CA & 15 CB that presents the opportunity to draw back these forms when necessary.

Suggested Read: Process for filing Income Tax Return for an NRI

15 CA online

File Form 15 CA for any payment made outside India with Ebizfiling at an affordable prices

About Ebizfiling -

2 thoughts on “Submission of Form 15 CA and Form 15 CB under Income Tax Act”

Leave a Reply

Reviews

-

I find the service, working approach and commitments very professional. Their progress updates are commendable. I really liked working with them.

-

I would surely give them 5 stars for their Services, Staff, and Pricing!

-

My GST process was made easier with Ebizfiling. I really appreciate the hard work by your team. Keep up the same in the future. Good Luck!

It’s really a great and helpful piece of information. I am happy that you shared this helpful information with us. Please keep us informed like this. Thank you for sharing.

Hi Cherie,

Your kind words truly made our day, and we’re thrilled to hear that you had a positive experience. Feel free to connect us at info@ebizfiling.com or +919643203209 for any query. We are here to help.