-

April 28, 2022

“What is DSC?”, “How to register DSC on new Income Tax Portal?” And Prerequisite for Income Tax DSC Registration on new Income Tax Portal

The Central Board of Direct Taxes (CBDT) announced the new Income Tax Filing site on May 20, 2021, and the e-filing facility was introduced on June 7, 2021. This new platform can be used to submit ITRs (Income Tax Returns) and other tax-related tasks. The website has a fresh appearance and a number of features that make it easier to conduct all tax-related tasks quickly. This article focuses on the “How to register DSC on new income tax portal?”

Introduction

For specific taxpayers and services, a Digital Signature Certificate is required. Companies and political parties must use a Digital Signature Certificate (DSC) to e-verify their ITR (Income Tax Return). Those whose books of accounts are subject to a tax audit should also e-verify their tax returns. It is optional for others. Before going through “How to register DSC on new Income Tax Portal?” Let’s have a quick look at “what is DSC (Digital Signature Certificate)?”

What is DSC (Digital Signature Certificate)?

Digital Signature Certificates are the electronic version of a physical or paper certificate. It’s used to check someone’s or an organization’s identity online or on a computer. The same way a handwritten signature confirms a printed or handwritten document, DSC verifies an electronic document. DSC can also be used to e-verify a taxpayer’s returns, among other things.

About Register DSC in new Income Tax Portal

All registered users of the e-Filing portal have access to the Register Digital Signature Certificate (DSC) feature. Registered users can use this service to do the following:

-

Create a DSC account.

-

When your registered DSC expires, you must re-register.

-

If your DSC hasn’t expired, you’ll need to re-register.

-

Register the Principal Contact’s DSC.

All users who want to utilize DSC on the new site must use the ‘Register DSC’ feature to re-register their DSC. Due to security and technological concerns, DSCs registered on the previous e-filing system will not be moved to the new platform.

Prerequisite for Income Tax DSC Registration on new Income Tax Portal

-

It is necessary for a taxpayer to have a valid user ID and Password to register under Income Tax E-Filing Portal.

-

The em-signer software needs to be downloaded and installed (the utility can also be downloaded and installed while registering DSC)

-

The DSC USB token should be Class 2 or Class 3 and obtained from a Certifying Authority Provider.

-

The certificate DSC that is to be registered must be active and not expired, and it must not have been cancelled.

How to register DSC on new Income Tax Portal?

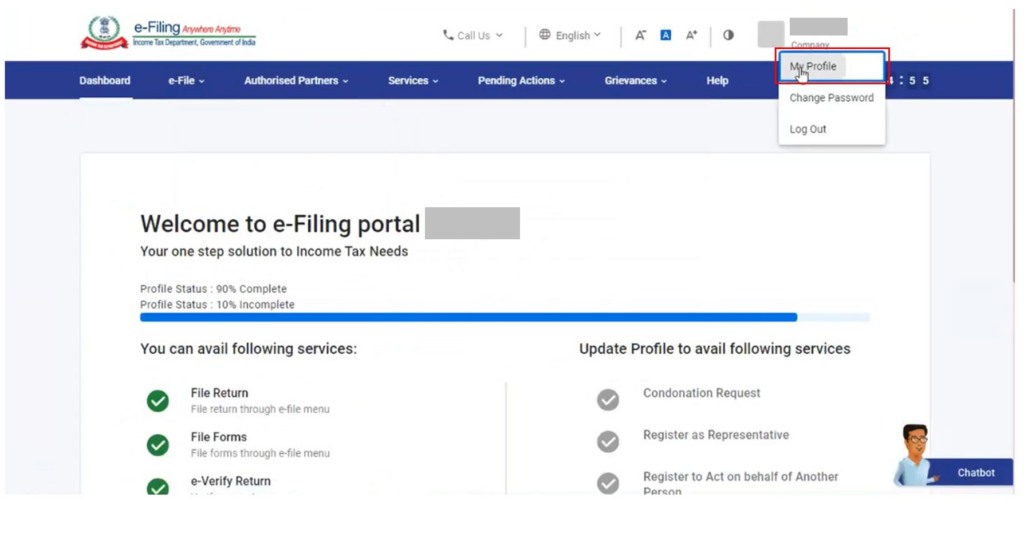

With your User ID and Password Login to Income Tax E-filing Portal

- From there go to the My Profile Page

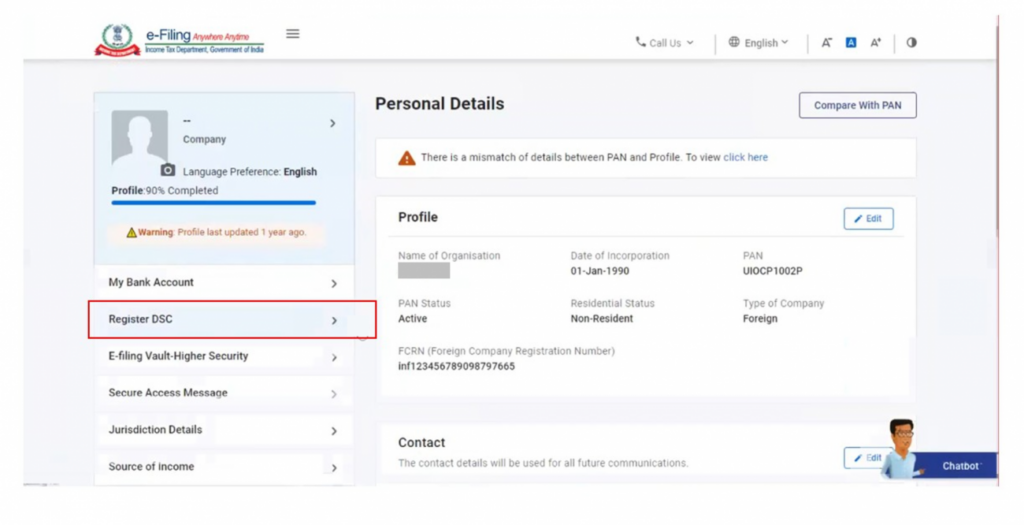

- On the Left Side of the screen click on Register DSC (Digital Signature Certificate)

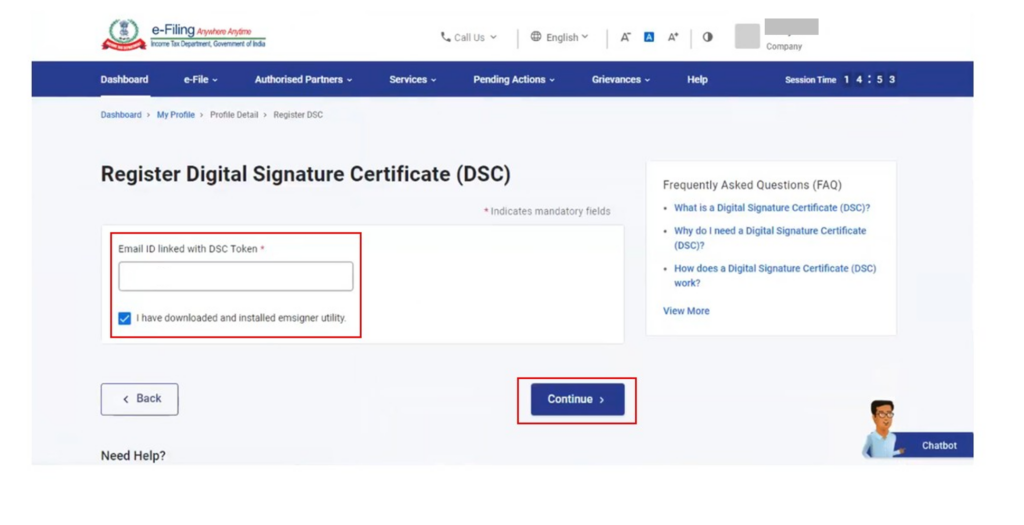

- Fill in the email address associated with the DSC token. Click Continue after selecting I have downloaded and installed the emsigner application.

- Enter the provider password and the certificate, after that click on Sign

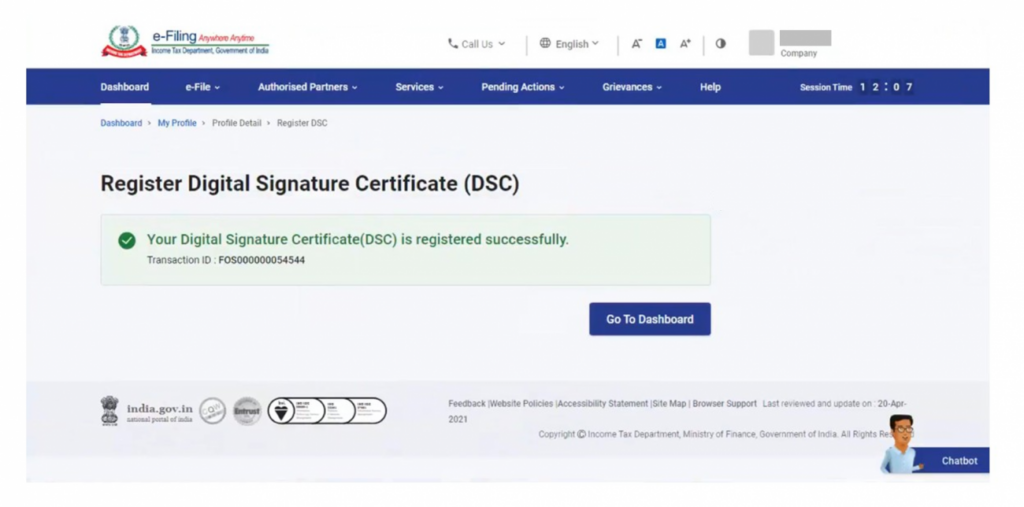

- A success message will appear after successful validation, with the option to go to the Dashboard.

Source: Income Tax Department Government of India

Important Points for DSC Registration on Income Tax

-

‘Your registered DSC has already expired,’ it will say if your DSC has expired. Please re-register with a current DSC’.

-

If you want to re-register an unexpired DSC, go to ‘View’ and look at the details, or go to ‘Update’ and do so.

-

If you want to register the DSC with the principle contact, input the principal contact’s email address from the e-filing site and continue to the DSC registration page.

FAQs (Frequently Asked Questions)

1. How can I make an ITR DSC signature?

Go to Income Tax e-filing Portal and select ‘Offline Utilities’ to register for DSC on the income tax website.

2. Is it necessary for me to re-register my DSC in the new e-Filing portal?

Yes, even if your previously registered DSC is active, you will need to register DSC again in the new e-Filing portal. Due to technical and data security concerns, DSC data is not being moved from the old platform.

3. Is a user’s DSC always associated with his or her PAN?

Except in the instance of a Non-Resident Director of a Foreign Company, DSC will be recorded against the individual user’s PAN (Permanent Account Number). DSC will be registered under the email ID of a Non-Resident Director of a Foreign Company.

4. What is an emsigner, exactly?

The utility emsigner is necessary for DSC registration on Income Tax Portal. It comes in a variety of forms that are appropriate for various websites. On the e-Filing portal, there is a link to download and install the emsigner software for registering the DSC (Digital Signature Certificate).

Conclusion

For e-filing income tax returns, a DSC (Digital Signature Certificate) is necessary. DSC is used to sign forms, such as Income Tax Returns, that require the user’s authentication. It is used to verify an individual’s or an organization’s identification for online transactions.

Digital Signature Certificates

Buy Class 2 & Class 3 Digital Signatures for Income tax returns, ROC Forms, GST and Tenders.

About Ebizfiling -

Reviews

Aditya Raje

23 Apr 2022Have used their services to open an MSME firm and FSSAI aswell. Mr. Shubham and Mr. Pulkit were extremely helpful and I got my work done smoothly and on time. Recommended.

LEROY D’MELLO

01 Oct 2018Highly recommended - I have been using their services for the past 2 years. Work completed very thoroughly and on time. Very efficient team, and responsive to all queries.

Nayanshree Barsaiyan

08 Jul 2019My requirement was fulfilled on time. the customer care response is very prompt.

February 20, 2026 By Steffy A

Best Income Tax Software for Indian Taxpayers Introduction Filing Income Tax Returns (ITR) is a mandatory annual task for Indian taxpayers and often a stressful one. As per the Income Tax e-filing portal guidelines, taxpayers must submit their ITR […]

January 31, 2026 By Dhruvi D

Preparing and Filing Federal Tax Returns for US Taxpayers Introduction Filing federal tax returns is a yearly responsibility that many US taxpayers find stressful. The process often feels complicated because it involves multiple forms, deadlines, and rules that change […]

January 30, 2026 By Dhruvi D

Key Federal Tax Credits and Deductions for US Taxpayers Begin With, Many US taxpayers pay more tax than required simply because they are not aware of available federal tax credits and deductions. These benefits are designed to reduce tax burden, […]