What are the Usage of CIN number?

Corporate Identification Number (CIN), serves various important purposes. Here are some of the key usages of the Corporate Incorporation Number:

1. Legal Identification: The CIN provides a unique identification for a company, enabling it to be legally recognized and distinguished from other entities.

2. Regulatory Compliance: The CIN is used for fulfilling various statutory and regulatory compliance requirements imposed by government authorities and agencies.

3. Business Transactions: The CIN is often required during business transactions, such as opening bank accounts, entering into contracts, or applying for licenses and permits.

4. Public Information: The CIN is publicly available and can be used by stakeholders, investors, and the general public to access information about the company’s registration details, financial reports, and other relevant data.

5. Transparency and Accountability: The CIN promotes transparency and accountability by ensuring that companies can be easily identified and their activities tracked by regulatory bodies, shareholders, and the public.

When Corporate Identification Number (CIN No.) Need to Update

In the following situations, your company’s Corporate Identification Number (CIN) must be updated:

- Change in Ownership Structure: When the ownership structure of your company changes, such as transitioning from a sole proprietorship to a private limited company.

- Relocation of Registered Office: When your company’s registered office moves to a different state.

- Change in Stock Market Listing Status: If your company moves between being listed (L) and unlisted (U) on the stock market.

- Alteration in Industry Focus: If your company undergoes a change in industry focus since its establishment.

- Registrar of Companies Change: If the authority overseeing your company’s affairs, known as the Registrar of Companies, changes.

Conclusion

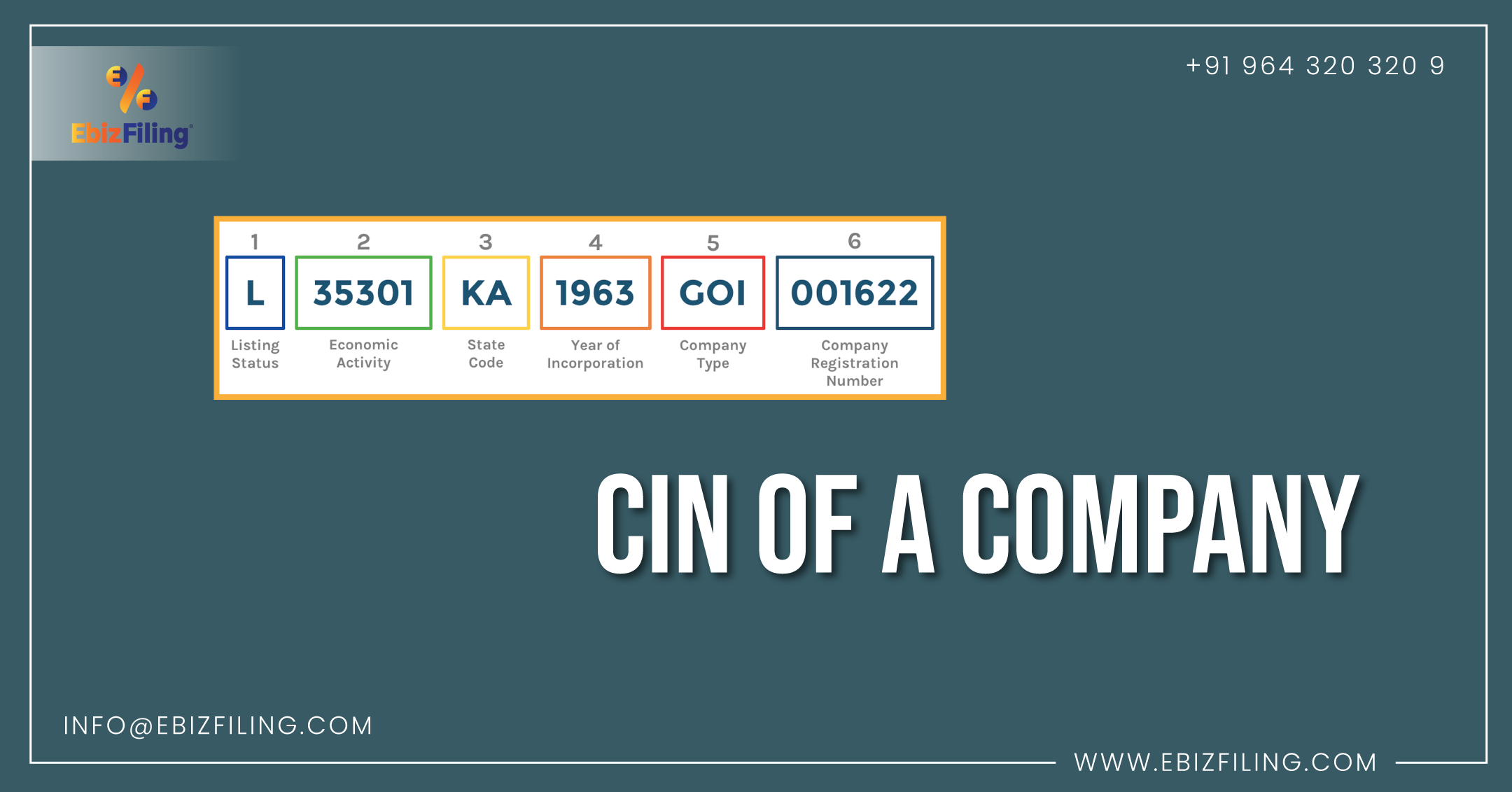

A Business Registration Number, commonly known as a CIN (Corporate Identification Number), is a unique identification number provided by the ROC (Registrar of Companies). Simply put, a CIN is a unique code that contains a company’s identification number as well as additional information about its operations.

This was a really informative post! I had heard of the Corporate Identification Number (CIN) before, but your explanation clarified its importance and how it ties into company registration. This will definitely help me in understanding more about company compliance. Thanks for sharing!