-

November 17, 2023

What things to consider during the ITR Form Filing Process?

Introduction

Income Tax Return (ITR) filing is an annual ritual for all taxpayers in India. It is a legal obligation that every individual, company, or firm must fulfill. ITR form filing is a crucial process that requires attention to detail and accuracy. In this blog, we will discuss the seven things to keep in mind when filing an Income Tax Return in India.

What are ITR Forms?

Income Tax Return (ITR) forms are official documents that taxpayers use to report their income, claim deductions, and compute their tax liability for a particular financial year. These forms serve as a medium for individuals, Hindu Undivided Families (HUFs), partnership firms, and other entities to provide the necessary information to the Income Tax Department. The ITR form filing varies based on the type of taxpayer and the nature of income earned. Each form corresponds to a specific category of taxpayers and facilitates the reporting of income from various sources such as salary, house property, capital gains, business or profession, and other income.

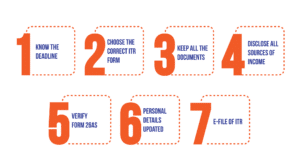

What are the 7 things to keep in mind when ITR Form Filing in India?

Here are 7 crucial things to keep in mind when filing your Income Tax Return in India:

Let’s see the detailed explanation of things to remember while ITR form filing in India:

1. Know the deadline

The first and foremost thing to keep in mind is the deadline for ITR Form Filing. The due date for filing ITR forms in India is July 31st for the non-audit assessee and October 31st for the audit assessee for the year 2023. However, the deadline may vary depending on the type of taxpayer and the income earned during the financial year. It is essential to know the deadline and e-filing ITR forms before the due date to avoid penalties and interest.

2. Choose the correct ITR form

The next thing to keep in mind is to choose the correct Income Tax Return form. There are different ITR filing forms available for different types of taxpayers and income sources. It is crucial to choose the correct ITR form to avoid rejection or scrutiny by the Income Tax Department.

3. Keep all documents ready

Before E-filing ITR, it is essential to keep all the necessary documents ready. These documents include Form 16, capital gains statements, Form 26AS, interest certificates, and many more. It is crucial to verify these documents for accuracy and completeness before ITR Form Filing.

4. Disclose all sources of income

One of the most critical things to keep in mind when ITR filing is to disclose all sources of income. Mentioning all different incomes along with their sources is mandatory at the time of the ITR filing form, even if such income is exempt from tax. Additionally, if you have changed jobs during the financial year, make sure you disclose income received from both your current as well as previous employer in your Income Tax Return in India.

5. Verify Form 26AS

Form 26AS is one of the critical documents you must verify before the ITR form filing. This form is similar to a passbook and includes your earnings, Tax Deducted at Source (TDS), advance tax paid, etc. Form 26AS also contains details of any tax credits that you might be eligible for. These tax credits can be used to offset future tax liabilities or to receive a refund for excess tax paid.

6. Keep your personal details updated

It is essential to keep your personal details up to date. Make sure that your personal details are updated, such as your name, address, and PAN number, Adhaar card. Any discrepancy in personal details can lead to rejection or scrutiny of your Income Tax Return in India.

7. E-file your ITR

E-filing ITR is a convenient and hassle-free way of filing your ITR Forms. It is faster, more secure, and can be done from the comfort of your home or office. E-filing ITR also ensures that your Income Tax Return is filed on time and reduces the chances of errors or mistakes.

Summary

Filing your Income Tax Return in India is a significant financial responsibility, but understanding these crucial pointers can make the process more manageable and efficient. By adhering to these tips, you can ensure a smooth and error-free experience when e-filing ITR in India. Stay informed, keep records updated, and follow the guidelines to fulfill your tax obligations seamlessly.

File Income Tax Returns

Filing of Income Tax return is necessary if you have earned any income.

About Ebizfiling -

Reviews

Akshay Apte

16 Apr 2018They have managed my Company’s Annual Filling in a way no one could. We are really happy with their services. Great going!

Deepika Khan

29 Sep 2018I would rate 5/5 for their services, pricing and transparency.

madhu mita

24 Aug 2021It's an awesome experience with Ebizfiling India Pvt Ltd. My special thank you to LATA Mam and i really appreciate her for the services she provide. LATA Mam is so cooperative always and always ready to help and solve any query related to their services.The way they communicate as per the time schedule is really awesome and satisfying, This is second financial year we are connected with Ebizfiling for Annual Returns filing as I really like their work culture, every employees are so cooperatives and available to respond any query whenever needed.Thank you so much to Ebizfiling Team!

March 5, 2026 By Dhruvi D

AI-Enabled Outreach Programme by SEBI for UPI Handles Overview Over the past ten years, India’s digital payment ecosystem has expanded quickly, with UPI emerging as the mainstay of routine financial transactions. But as more people accept digital technology, so […]

March 3, 2026 By Steffy A

Companies Compliance Facilitation Scheme (CCFS-2026) Let’s Understand Many companies in India are currently facing heavy late filing penalties. If your company has not filed annual returns or financial statements on time, the additional fee continues to increase at ₹100 […]

February 24, 2026 By Steffy A

How to Start a Business When You Have No Ideas? Introduction Many people want to start a business but struggle because they don’t know what business idea to choose. If you feel stuck, you are not alone. The truth […]