-

November 25, 2022

A Limited Liability Partnership (LLP) is a partnership in which partners have limited liability. It can exhibit characteristics of both partnerships and companies. In an LLP, an individual partner is not responsible or liable for any other partner’s misconduct or negligence. LLP was introduced in India in the Limited Liability Partnership Act, 2008. In this article we will discuss in detail the LLP registration fees and process for LLP incorporation in India.

Table of Content

The fees charged by the government to Register an LLP

(LLP registration fees charged by the Government)

- Digital signature (DSC) may cost you around Rupees 1500-2000 (Depending on the Agency).

- Also Director’s Identification Number if it is needed to be obtained via form DIR 3 KYC then, may cost around INR 1000/- for two directors.

- While reserving the name for LLP may cost you around INR 200/–

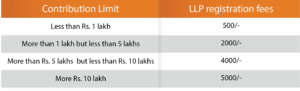

Government fees for registration of Limited Liability Partnership (in form FiLLiP) including conversion of a firm or a private company or an unlisted public company into Limited Liability Partnership

Note: If in the course of business there is substantial increase in the contribution then the difference between the fees payable on the increased slab of contribution and the fees paid on the preceding slab of contribution shall be paid through Form 3.

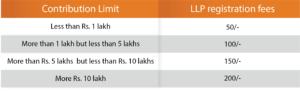

Government fees for filing, registering or recording LLP agreement, any document, form, statement, notice, Statement of Accounts and Solvency, annual return and an application along with the Statement for conversion of a firm or a private company or an unlisted public company into LLP by this Act or by these rules required or authorized to be filed, registered or recorded

However, stamp duty may vary based on the state where LLP is formed. All in all the LLP registration fees in India depends mainly on the total of capital contribution made by the partners and stamp duty of the particular state where the LLP is being registered.

LLP registration process in India

LLP registration process includes following steps:

-

Get a digital signature (DSC)

The documents of the registration of LLP are to be filed online and are required to be digitally signed. Hence, before registering your LLP, you must apply for the digital signature of the designated partners of the proposed LLP.

-

Apply for the Director Identification Number (DIN)

Once you get the DSC, you will have to apply for the DIN of all the designated partners of the proposed LLP.

-

Get the name of the company approved through ‘Reserve your Unique Name’ service (RUN)

To get a name for LLP is the most important step. LLP-RUN (Limited Liability Partnership – Reserve Unique Name) is filed for the reservation of name of proposed LLP.

-

Incorporation of LLP (Form FiLLiP)- including DIN Application & PAN and TAN Application

The next step would be to file the form for incorporation of LLP i.e. FiLLiP (Form for incorporation of Limited Liability Partnership) which shall be filed with the Registrar who has a jurisdiction over the state in which the registered office of the LLP is situated. This form also provides for applying for allotment of DPIN if an individual who is to be appointed as a designated partner does not have a DPIN or DIN. Also, PAN and TAN Application can now be applied with the Incorporation Form itself (with the introduction of LLP (Second Amendment) Rules, 2022).

-

File ‘Limited Liability Partnership Agreement’

Once your name is reserved, LLP agreement which governs the mutual rights and duties amongst the partners and also between the LLP and its partners, must be prepared and filed online. The LLP agreement is to be filed in Form 3. The LLP Agreement has to be printed on Stamp Paper. The value of Stamp Paper is different for every state.

Limited Liability Partnership (Second Amendment) Rules, 2022

Also, there are a few more important changes have been made through LLP (Second Amendment) Rule, 2022, which are as follows:

- There can be 5 instead of 2 Designated Partners (without having DIN) at the time of Incorporation.

- All the forms of LLP have now become web-based.

- LLPs shall be allotted their PAN and TAN along with the Certificate of Incorporation itself.

- The Statement of Account and Solvency shall now be signed on behalf of the LLP by its an interim resolution professional.

- For filing Consent of Partners, a web-based Form 9 shall be made available.

Know More: LLP (2nd Amendment) Rules, 2022.

Documents required for LLP registration in India

- Photograph of all the Partners

- PAN Card of all the Partners

- ID Proof of all the Partners (Driving License/Passport/Voter ID)

- Electricity Bill or any other utility bill for the address proof of the Registered Office

Limited Liability Partnership

Register Limited Liability Partnership with Ebizfiling at affordable prices

About Ebizfiling -

16 thoughts on “LLP Registration fees Explained in detail, See how much you would need to spend if you want to register an LLP in India”

Leave a Reply

Reviews

-

They helped me with my company’s name change and I was quite satisfied with the way they served me. I am surely coming back to you in case of any compliance problem.

-

Ebizfilling.com is one of its kind of organization, believe me guys their working process is very smooth. I had an awesome experience regarding MSME certification. Thank you Kushani & Mansi for your wonderful efforts. Kudos to Ebizfiling, you are doing great keep doing it.

-

I was so satisfied with the services they provided to me. I had a great time working with them.

CAN I START WITH 2 DESIGNATED PARTNERS AND 2 NORMAL (SLEEPING PARTNERS)AT THE TIME OF REGISTRATION..

Hi Ram, yes that’s quite possible. team will get in touch with you shortly.

Can I start company for shares trading along with my family member. One will fund other will trade, profits will be shared with percentage as mutually agreed. I am working in PSU and other family member working in PVT firm. Initial investment will be 1 lac by other member. How much money and amount of time needed for company formation.

Hello sir,

Private Limited Company Registration cost is INR 7,199 and the time limit for the same is approximately 20-25 days. In case you have any other doubts, please write us your detailed query at info@ebizfiling.com/ contact us at +919643203209.

Thanks for connecting.

I have from 2016 proprietorship company active. i want to change my company proprietorship to LLP or partnership with three directors. please give fee detail and document requirements and other guide line.

Hello Sir,

You cannot convert your Proprietorship to any other entity, you will have to form a new LLP/Partnership. Kindly write us your detailed query at Please write us a detailed query at info@ebizfiling.com/ contact us at +919643203209, if you need any additional information or assistance.

Thanks for connecting.

Good day Sir,

Im a Nepalese citizen and would like to start a Pharmaceutical export/import company in India.

Can I open a 100% foreign company with 2 Nepalese citizen as shareholders in LLC or Pvt Ltd. company?

Hello sir,

We cannot extend our support for this service requirement as being a citizen of the neighbour country, you cannot register a company in India. . Please contact us at +919643203209 / mail us at info@ebizfiling.com, if you need any additional information or assistance.

Thanks for connecting.

Can family members be 2 directors for eg. Husband wife or Father and son?

Hi Mukesh,

Greetings from Ebizfiling!

Yes, two members of the same family can be directors in a company.

In case of any further query, you may write to us at info@ebizfiling.com or may call us on +919643203209.

Can a government servent be a partner of LLP ?

Yes, a government employee can be a partner in LLP.

To know more about this call on +919643203209 or you can mail us at info@ebizfiling.com.

Can Food service and Construction work both be done under one company?

Hello sir,

One cannot register these two different objectives under one company. You need to register these separately. Contact us at +919643203209 / mail us at info@ebizfiling.com, if you need any additional information or assistance.

I’m new in Bussiness and want to register company with partnership member

Hello Prameshwar Sharma,

Thank you for your Inquiry!

The team will get in touch with you soon. Meanwhile, you can get in touch with Ebizfiling at +919643203209 / info@ebizfiling.com