-

December 14, 2022

Benefits and Reasons to focus on PEO and EOR Services in India

Table of Content

Introduction

India is a burgeoning economic superpower with a global knowledge capital. India has many complex labor laws that are centuries old, and many of them have been updated with a few more complexities. Understanding all of the complexities and adhering to them will be a nightmare for any company, anywhere in the world. It is also a complicated issue for many Indian companies. Professional Employer Organization (PEO) or Employer of Records (EOR) is a method of utilizing India Talent. Here in this article, we will look into the reasons to focus on PEO and EOR services in India.

PEO (Professional Employer Organization)

A PEO is an organization that manages employee-related responsibilities and liabilities on you behalf as a co-employer. This means you can outsource human resource functions like payroll, employee benefits, compensation, taxes, and compliance to PEO services in India.

PEOs provide your employees with better and more affordable benefits, creating a win-win situation for you, your employees, and the PEO. Additionally, they ensure that you understand and follow Indian labor laws in order to avoid fines.

EOR (Employer of Records)

An EOR (Employer of Records) is a third-party organization that handles all human resource functions, from hiring to terminating. The primary difference between a PEO and an EOR is that the former requires the establishment of a legal entity in the country of operation. However, with an EOR, you can hire employees worldwide without establishing a foreign entity.

Another difference between a PEO and an EOR (Employer of Records) is that the latter does not offer a co-employment model. Instead, the EOR is the worker’s registered employer, removing any employment risks for your company.

What can EOR and PEO offer to your Company?

- Find and hire the best employees for your company in India.

- Ensure that their understanding corresponds to Indian regulations and guidelines.

- Oversee employee benefits and compensation.

- Make appropriate instalments for your employees.

- Manage your employees’ human resource needs.

8 Reasons to focus on PEO and EOR Services in India

- When you want to turn your foreign contractors into full-time employees.

- You and your contractor do not have a legally binding bid agreement.

- You are establishing a legal entity (which takes time) but need to hire foreign workers right away.

- You want to demonstrate your appreciation for contractors and temporary resources by converting them to full-time employees.

- Your contractors expect you to provide them with the same benefits as employees.

- You want a cost-effective way to convert overseas contractors into employees.

- You are not ready to set up a legal entity, but you still want to convert your contractors into full-time employees.

- Managing a foreign corporate entity’s compliance and financial requirements is neither feasible nor beneficial (in terms of costs and risks).

-

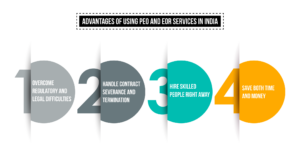

Overcome Regulatory and Legal Difficulties

A PEO or EOR organization can ensure that your payroll structure is correct, that you contribute to provident funds, that you deduct professional taxes, and that you make all necessary deductions.

They can manage a foreign entity’s financial and compliance requirements more effectively, lowering the risk of fines and penalties. Furthermore, they contribute to the enhancement of your brand’s reputation in the marketplace, attracting good talent and customers.

-

Save both time and money

The initial cost of establishing your subsidiary may appear low and feasible, but it can quickly add up. For example, there is ongoing spending on banking, office space, professional maintenance services, and so on.

You will also have to pay high legal and compliance fees to ensure that you are following government regulations.

When you work with an Indian PEO service provider, you pay them a mutually agreed-upon fee while they manage all of your organization’s HR and tax matters.

-

Handle contract severance and termination

Termination and severance are difficult concepts to grasp. Unfortunately, many employers overlook the pay and unused vacation time that can be cashed out. Even if the amount is small, it can lead to legal action.

However, your PEO/EOR provider can handle the entire process for you. This eliminates the possibility of legal issues, let alone brand reputation issues.

-

Hire skilled people Right Away

This is yet another significant benefit of working with an EOR provider. You can hire the right people for your company without forming a legal entity. Furthermore, you can test the Indian market before making a full-fledged investment. It is also useful if you are establishing a legal entity (which can take more time) but do not want to wait that long to hire employees and begin work.

Bottom Line

When expanding your business to India or hiring Indians, PEO and EOR service providers are the best option. They ensure that you follow local work regulations, reducing the possibility of legal issues. They also help you save money on employee management costs and overhead. All you have to do now is assign tasks to employees. Do you still have questions about PEO (Professional Employer Organization) and EOR? Please do not hesitate to contact EbizFiling experts.

HR Hiring and Recruitment

Hire qualified and skillful staff for your company with Ebizfiling. Acquire HR Hiring and Recruitment Services at Ebizfiling

About Ebizfiling -

Reviews

Dev Desai

19 Nov 2021Loves their services

Neha Mody

27 Nov 2017“Quite impressed with the professionalism and efficiency that ebiz- filing have demonstrated throughout! Everything runs like clockwork. This means that I can concentrate on building my profession and not be worrying about compliance requirements, the team takes care of it all. Excellent work!!"

Purvi Suru

09 Jun 2018A commendable job by your team for my MSME registration. I would surely give them 5 stars!

April 15, 2024 By Team Ebizfiling

Comprehending Taxation and Compliance for Transport Business Startup Understanding taxation and compliance is not just necessary, but crucial for entrepreneurs considering launching a transportation business. Before you understand how to start a travel business in India, you should read the […]

April 15, 2024 By Team Ebizfiling

What differentiates business permits from a business license? It can frequently feel like figuring out a complicated code to navigate the legal requirements. The terms “business license” and “business permits” frequently come up among the various regulations and documentation. While […]

April 15, 2024 By Team Ebizfiling

Travel Agency Registration Online: Legal requirements to start a business made simple Do you also dream about how to start a travel agency in India? Pretty exciting, right?? Imagine yourself assisting others in organizing their ideal getaways, visiting far-off places, […]