-

December 27, 2025

Understanding Safe Harbour Rules Under Indian Tax Laws

Let’s Understand

Safe harbour rules play an important role in India’s transfer pricing framework by offering certainty and reducing prolonged disputes with tax authorities. These rules allow eligible taxpayers to opt for predefined margins, helping them avoid detailed transfer pricing audits and litigation.

However, many businesses still find safe harbour provisions complex or incomplete. At Ebizfiling, we simplify safe harbour rules in a clear and practical way so you can make informed compliance decisions too, without unnecessary risk or confusion.

What Are Safe Harbour Rules in India?

Safe harbour rules refer to predefined conditions under which the Income Tax Department accepts the transfer price declared by a taxpayer. When a business follows these conditions, tax authorities do not carry out detailed transfer pricing checks. This approach helps reduce litigation and compliance burden. Safe harbour rules are prescribed under Section 92CB of the Income-tax Act, 1961. As per current CBDT guidelines, these rules aim to provide certainty to taxpayers engaged in international transactions with associated enterprises.

Why Were Safe Harbour Rules Introduced?

Transfer pricing disputes have been one of the most common tax challenges for multinational companies in India.

Audits often lead to adjustments, penalties, and long litigation.

Safe harbour rules were introduced to:

-

Reduce disputes between taxpayers and tax authorities

-

Provide predictability in transfer pricing outcomes

-

Simplify compliance for low-risk transactions

-

Save time and cost for both businesses and the department

How Do Safe Harbour Rules Work in Practice?

Safe harbour rules work on a self-declaration basis. Businesses engaged in eligible international transactions declare transfer prices within the prescribed margins. Once declared, the Income Tax Department accepts these prices without detailed examination. As observed in recent assessments, this mechanism helps businesses avoid lengthy audits and focus on operations instead of litigation.

What Is Transfer Pricing and Its Link with Safe Harbour Rules?

Transfer pricing refers to the pricing of transactions between related entities such as parent companies and subsidiaries. Indian tax laws require these transactions to follow the arm’s length principle. Safe harbour rules act as a relief mechanism within transfer pricing. If a taxpayer opts for safe harbour rules and meets the conditions, the declared transfer price is treated as arm’s length.

Read to know more on Transfer pricing at Arm’s length in India

Who Is an Eligible Assessee Under Safe Harbour Rules?

Rule 10TB defines the eligible assessee under safe harbour rules. The following taxpayers qualify:

-

Software development service providers with insignificant risk.

-

IT-enabled service providers or KPO service providers.

-

Assessees who have advanced intra-group loans.

-

Persons who have provided corporate guarantees.

-

Contract R&D service providers in software development.

-

Contract R&D service providers in generic pharmaceutical drugs.

-

Manufacturers and exporters of core or non-core auto components.

-

Recipients of low-value-adding intra-group services.

What Are Eligible International Transactions?

Income Tax Rule 10TD specifies eligible international transactions under safe harbour rules. These include:

-

Software development services

-

IT-enabled services

-

Knowledge process outsourcing services

-

Intra-group loans

-

Corporate guarantees within prescribed limits

-

Contract research and development services

-

Manufacture and export of non-core auto components

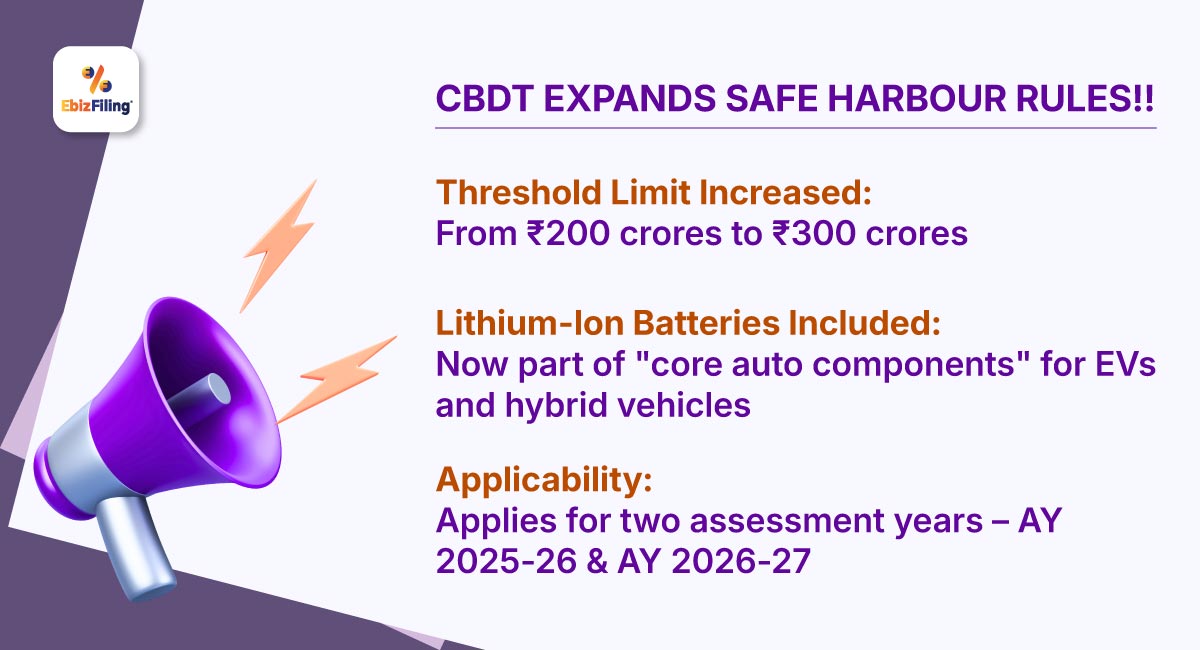

Latest Update: CBDT Expands Safe Harbour Rules

The Central Board of Direct Taxes (CBDT), through Notification No. 21/2025 dated March 25, 2025, has announced significant amendments to the Income-tax Rules, 1962, aimed at expanding the scope of safe harbour rules under Section 92CB of the Income-tax Act, 1961.

Key amendments

The CBDT has announced key amendments to safe harbour rules to improve tax certainty.

-

Increased Threshold Limit: The turnover threshold has increased from ₹200 crores to ₹300 crores. This change benefits larger taxpayers involved in high-value international transactions.

-

Inclusion of Lithium-Ion Batteries: Lithium-ion batteries used in electric and hybrid vehicles now qualify as core auto components. This update supports India’s clean mobility push.

-

Applicability for Two Assessment Years: The amendments apply for AY 2025-26 and AY 2026-27. This provides a stable compliance window for eligible taxpayers.

Below, we have attached a PDF regarding the CBDT official announcement on the expansion of Safe Harbour Rules,

cbdt-notifies-amendments-to-expand-safe-harbour-rules-2025-1742966688

How to Opt for Safe Harbour Rules?

Taxpayers must follow a defined procedure to opt for safe harbour rules:

-

File the income tax return before submitting Form 3CEFA

-

Submit Form 3CEFA to the Assessing Officer

-

Maintain prescribed transfer pricing documentation

-

File the accountant’s report in Form 3CEB by the due date

If authorities do not pass an order within the prescribed time, the safe harbour option is treated as valid.

When Do Safe Harbour Rules Not Apply?

Safe harbour rules do not apply to transactions with associated enterprises located in countries notified under Section 94A. These include non-cooperative or low-tax jurisdictions.

Benefits of Safe Harbour Rules in India

Safe harbour rules offer several advantages:

-

Safe harbour rules provide predictability in profit margins and pricing, helping businesses plan taxes with better clarity.

-

They reduce the risk of transfer pricing litigation by limiting detailed scrutiny from tax authorities.

-

Declared transfer prices are accepted faster, which avoids prolonged audits and assessment delays.

-

Businesses face lower compliance and audit costs due to reduced documentation reviews and fewer disputes.

-

The simplified self-assessment mechanism allows taxpayers to comply with transfer pricing rules more efficiently.

How Ebizfiling Helps with Safe Harbour Rules ?

At Ebizfiling, we support businesses through every stage of compliance:

-

We review your eligibility under safe harbour rules based on your transaction type, risk profile, and applicable income tax provisions.

-

We assist in the accurate preparation and timely filing of Form 3CEFA and Form 3CEB as per current transfer pricing rules.

-

We help you maintain proper and compliant transfer pricing documentation to support your safe harbour position during assessments.

-

We guide you on recent safe harbour amendments, threshold changes, and their applicability to your business transactions.

-

We ensure all timelines, filings, and declarations remain on track to avoid notices, delays, or compliance gaps.

Suggested Read :

CBDT Latest News: Due Date Extended for Audit Report Filing for FY 2024-25

What is Section 115BAC? And CBDT Clarification on Section 115BAC of Income Tax Act, 1961

Income Tax Department Cracks Down on Fake Party Fraud

In Short ,

Safe harbour rules offer a practical solution for simplifying transfer pricing compliance in India. With recent amendments, more taxpayers can now benefit from reduced scrutiny and better certainty. At Ebizfiling, we help businesses apply safe harbour rules correctly and confidently.

Frequently Asked Questions on Safe Harbour Rules

1. What are safe harbour rules under income tax law?

Safe harbour rules allow eligible taxpayers to declare transfer prices that are automatically accepted by tax authorities, reducing the need for detailed transfer pricing scrutiny or prolonged assessments.

2. Which section governs safe harbour rules in India?

Safe harbour rules are governed by Section 92CB of the Income-tax Act, 1961, and are supported by detailed rules notified by the CBDT.

3. Who can opt for safe harbour rules?

Eligible assessees include software development service providers, IT-enabled service (ITES) providers, research and development service providers, auto component manufacturers, and entities engaged in specified international transactions.

4. What is the latest threshold limit under safe harbour rules?

The threshold limit has been increased from ₹200 crores to ₹300 crores as per the latest amendments notified by the CBDT.

5. Are lithium-ion batteries covered under safe harbour rules?

Yes. Lithium-ion batteries used in electric and hybrid vehicles are now classified under core auto components and are covered by the safe harbour provisions.

6. For which assessment years are the new amendments applicable?

The revised safe harbour rules are applicable for Assessment Years 2025–26 and 2026–27.

7. What forms are required to opt for safe harbour rules?

Taxpayers opting for safe harbour must file Form 3CEFA and submit an accountant’s report in Form 3CEB within the prescribed timelines.

8. Can taxpayers use MAP after opting for safe harbour rules?

No. Once a taxpayer opts for safe harbour rules, they are not eligible to invoke the Mutual Agreement Procedure (MAP) for the same transactions.

9. Do safe harbour rules apply to tax haven jurisdictions?

No. Safe harbour rules do not apply to transactions with entities located in countries or territories notified as non-cooperative jurisdictions under Section 94A.

10. How can Ebizfiling assist with safe harbour compliance?

Ebizfiling offers end-to-end assistance including eligibility assessment, documentation support, form filings, and ongoing compliance guidance aligned with the latest transfer pricing and tax regulations.

Form FC-GPR under Single Master Form of RBI

Does your Company wish to receive Foreign Direct Investment? Does your Company wish to allot shares to foreigners against such investment? Under Fema Compliance, filing Form FC-GPR within 30 days is mandatory.

About Ebizfiling -

Reviews

Ahmed Shaikh

23 Sep 2018Ms. Ishani and other team members are very helpful in the entire process of GST filing.

I really appreciate their support superb team.

Cheers!!!!*****

Kriday Thakkar

04 Mar 2018The service I received was great, quick and hassle-free. Looking forward to work with you in future.

Sachin Chokshi

04 Jan 2018"ebizfiling has given us a one stop solution. The accuracy, technical expertise and personal assistance are consistent. They have professional approach and provide innovative solutions. I could focus on my operations and my compliance would be done from time to time. Kudos to the team."

February 20, 2026 By Steffy A

Best Income Tax Software for Indian Taxpayers Introduction Filing Income Tax Returns (ITR) is a mandatory annual task for Indian taxpayers and often a stressful one. As per the Income Tax e-filing portal guidelines, taxpayers must submit their ITR […]

February 23, 2026 By Steffy A

Why Online Legal Services Are Growing in India ? Introduction The legal industry is evolving rapidly as technology reshapes how legal assistance is delivered. In India, online legal services are growing because they address historical challenges such as court […]

February 19, 2026 By Steffy A

Why More Businesses Are Choosing Outsourcing Legal Work? Introduction. Businesses are increasingly turning to outsourcing legal work to manage compliance, contracts, and regulatory responsibilities more efficiently. Through Legal Process Outsourcing, companies can reduce operational costs while gaining access to experienced […]