-

April 2, 2025

What are the Responsibilities of Director in pvt ltd Company?

Introduction

The Director serves as the backbone of a company. A director of a Private Limited Company must fulfill important duties and responsibilities. However, many directors hold the position in name only and remain unaware of their actual roles. This blog highlights the responsibilities of a director in a Private Limited Company to help build well-governed businesses.

What does a Company Director mean?

A director is ordinarily someone appointed to manage a company’s business and affairs. Directors act in the best interest of the company by setting strategies and protecting stakeholder interests.Every registered company must have at least one director.

What responsibilities does a director have in a Pvt Ltd Company?

Directors with strong power and authority perform numerous roles and responsibilities, ensuring all essential activities in a company are carried out.

- Follow company rules and legal powers: Directors must act within the authority given by company laws and the Articles of Association, ensuring all decisions align with legal and regulatory requirements.

- Work for the company’s growth and success: Directors must prioritize the company’s long-term success, benefiting employees, customers, and shareholders while making responsible business decisions.

- Make decisions independently: Directors should abide by their own judgment, free from external pressure or personal influence, ensuring decisions are in the company’s best interest.

- Act with care, skill, and responsibility: Directors must perform their duties diligently, using their expertise and knowledge to make well-informed and responsible choices for the company.

- Avoid personal conflicts of interest: Directors should not use their position for personal gain and must disclose any conflicts that may affect their ability to act in the company’s best interest.

- Treat all company members fairly: Directors must ensure fair treatment of all shareholders and stakeholders, balancing the interests of different members without bias or favoritism.

- Misusing the company’s assets: to ensure that the company’s assets are used responsibly and exclusively for business purposes, avoiding any personal gain.

- Attend the company’s meetings: Attendance at the company’s meetings is mandatory for staying informed about business decisions.

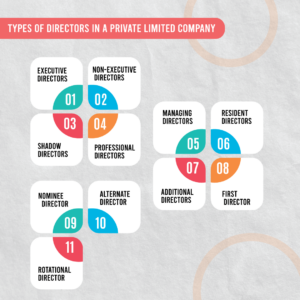

Types of Directors in a Pvt ltd company

Eligibility to become a Director

To be eligible to become a director of a company, an individual must meet the following criteria:

-

Age: The individual must be at least 21 years old but not more than 70 years of age.

-

Insolvency: The individual should not be an undischarged insolvent.

-

Criminal Record: The individual must not have committed a serious offense or served more than 6 months in prison in the past.

-

Disqualification: The person must not be disqualified under the Companies Act, such as being bankrupt or found guilty of fraud.

-

Director Identification Number (DIN): The individual must obtain a Director Identification Number (DIN) from the (MCA).

-

Mental Competence: The individual must be of sound mind and capable of taking rational decisions for the company’s affairs and employees’ interests.

Roles Vs Responsibilities of Director in pvt ltd Company

| Aspect | Roles | Responsibilities |

| Definition | The functions a director performs in managing the company. | The duties a director must fulfill as per the law and company policy. |

| Decision-Making | Making strategic decisions for the company. | Ensuring decisions align with the company’s goals and legal requirements. |

| Leadership | Leading the company’s operations and guiding the team. | Providing oversight and direction in line with the company’s objectives. |

| Compliance | Ensuring the company operates within legal boundaries. | Ensuring compliance with laws, regulations, and corporate governance standards. |

| Financial Oversight | Setting company budgets and financial strategies. | Managing company funds responsibly and approving financial statements. |

| Stakeholder Communication | Representing the company to stakeholders. | Communicating effectively with shareholders, employees, and external parties. |

Role of director in ROC filing for Pvt Ltd Company

A director in a Private Limited Company is responsible for ensuring timely and accurate ROC (Registrar of Companies) filings to maintain legal compliance. Their role includes:

- Overseeing the filing of annual returns (MGT-7) and financial statements (AOC-4).

- Ensuring timely compliance with the Companies Act, 2013.

- Approving and signing necessary documents before submission.

- Monitoring other statutory filings, such as director KYC (DIR-3 KYC) and changes in company structure (such as shareholding or directorship changes via forms like DIR-12 and MGT-14).

- Coordinating with company secretaries and professionals to avoid penalties or legal issues.

Their primary duty is to ensure the company meets its ROC obligations to maintain good standing with regulatory authorities.

NOTE : Our Pvt Ltd ROC filing service ensures timely compliance with annual returns, financial statements, and legal requirements to avoid penalties.

Conclusion

A company director is responsible for running a limited company on behalf of its shareholders and promoting the business’s success. Hence, a Director’s existence in a Company is really essential as directors deal with all routine business matters related to running the business.

Suggested Read :

Executive and Non-Executive Director

Appointment of Director

Got an able person to take up directorship ? Appoint a Director in your company with the help of Ebizfiling at an Affordable Price

About Ebizfiling -

Reviews

Dhwani Tanna

17 Jun 2018Great going Ebizfiling! We are satisfied with your services and would recommend them to others. Good luck for your future.

Janvi Seth

14 May 2018I wanted to register my business on E-commerce and my colleague suggested me Ebizfiling. I am glad we made the right choice of choosing them.

Kavita Desai

09 Dec 2017I would give 5 stars for their efficiency and their services.

February 19, 2026 By Steffy A

Why Automation Is Becoming Essential for Business Compliance Introduction Companies today must follow multiple regulations, maintain proper records, and respond quickly to audits or legal updates. Traditional manual methods are no longer enough to manage growing compliance demands. Automation […]

February 18, 2026 By Steffy A

Consulting Firms vs Compliance Platforms: Which to Choose in 2026? Introduction At Ebizfiling, we often hear this question from clients: “Why hire a consulting firm when compliance platforms are cheaper?” While compliance platforms are more affordable, they often […]

February 19, 2026 By Steffy A

Top ROC Filing Tools Every Business Should Know Introduction ROC filing is an important responsibility that businesses cannot ignore. Under the Companies Act, 2013, every registered company must submit annual returns and financial statements to the Registrar of Companies […]