-

August 20, 2025

-

ByDhruvi D

Can an NRI or Foreigner Become a Director in an Indian Private Limited Company? (2025 Guide)

Introduction

Indian businesses are increasingly engaging with global talent and investment. Naturally, NRIs and foreign nationals often take up roles as directors, shareholders, or even Managing Directors (MDs) in Indian private limited companies.

This raises some important questions:

- Can an NRI or foreigner be appointed as a director or MD?

- Can they invest in Indian companies?

- Are they eligible to receive a salary?

- What compliance steps are needed under MCA, FEMA, and RBI?

Let’s break it down clearly for business owners and legal teams.

Can an NRI or Foreigner Be Appointed as a Director?

Yes. The Companies Act, 2013, allows NRIs and foreign nationals to be appointed as directors in Indian companies.

Types of Director Roles:

At least one director must be a resident Indian (stayed in India for 182+ days in the previous calendar year).

Can an NRI or Foreigner Invest in an Indian Company?

Yes. They can own shares and even 100% equity in an Indian private limited company, subject to sectoral FDI limits.

| Query | Answer |

| Can an NRI invest in Indian companies? | Yes (under FDI regulations) |

| Can a foreigner hold 100% of Indian equity? | Yes (under automatic route) |

| Is RBI approval required? | Not in most sectors |

| Can NRI be both director and shareholder? | Yes |

FDI through the automatic route does not require prior RBI approval but must be reported via Form FC-GPR on the FIRMS portal.

Step-by-Step Guide to Appoint a Foreign or NRI Director

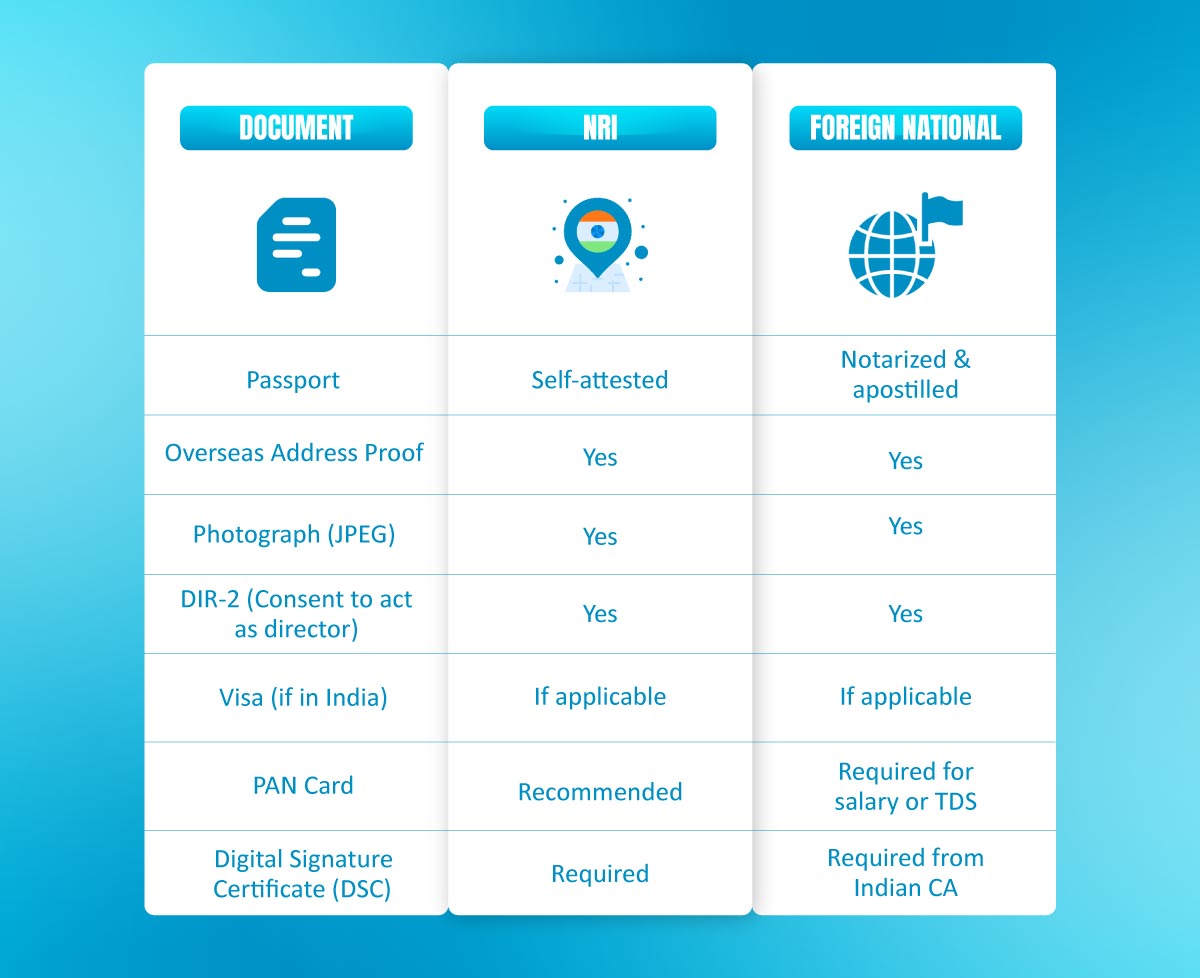

Step 1: Apply for DSC (Digital Signature Certificate)

Issued by Indian certifying authorities. Foreign documents must be notarized and apostilled or consularized.

Step 2: Apply for DIN (Director Identification Number)

DIN can be applied through SPICe+ form during company incorporation or DIR-3 form for post-incorporation appointments.

Step 3: Board Resolution

Pass a board resolution for appointment if post-incorporation.

Step 4: File DIR-12

Mandatory MCA form to be filed within 30 days of appointment.

Document Checklist

Can an NRI or Foreign Director Be Paid a Salary in India?

Yes. An Indian company can pay salary, sitting fees, commission, or other remuneration to an NRI or foreign director. Tax compliance must be followed.

Key Points:

- PAN is required for TDS purposes.

- Remuneration is taxable in India if services are rendered in India.

- FEMA compliance is essential if salary is remitted abroad.

TDS Chart:

| Nature of Payment | TDS Section | TDS Rate | PAN Required |

| Independent Director Fee | 194J | 10% | Yes |

| Executive Director Salary | 192 | As per slab | Yes |

| Without PAN | 206AA | 20% | Yes |

Common Scenarios and Clarifications

| Scenario | Allowed | Notes |

| NRI as Co-founder & Director | Yes | At least one Indian resident director required |

| Foreign national as Managing Director | Yes | Subject to board approval and compliance |

| 100% ownership by foreigner | Yes | Allowed in many sectors under FDI |

| Appointment without visiting India | Yes | Documents must be duly certified |

| Salary paid abroad in foreign currency | Yes | Through authorized channels under FEMA |

Can a Foreigner Be an Independent Director?

Yes. For companies required to have independent directors, foreign nationals can qualify if:

-

They meet Companies Act criteria.

-

They are registered on the Independent Director databank.

-

They have valid DIN and DSC.

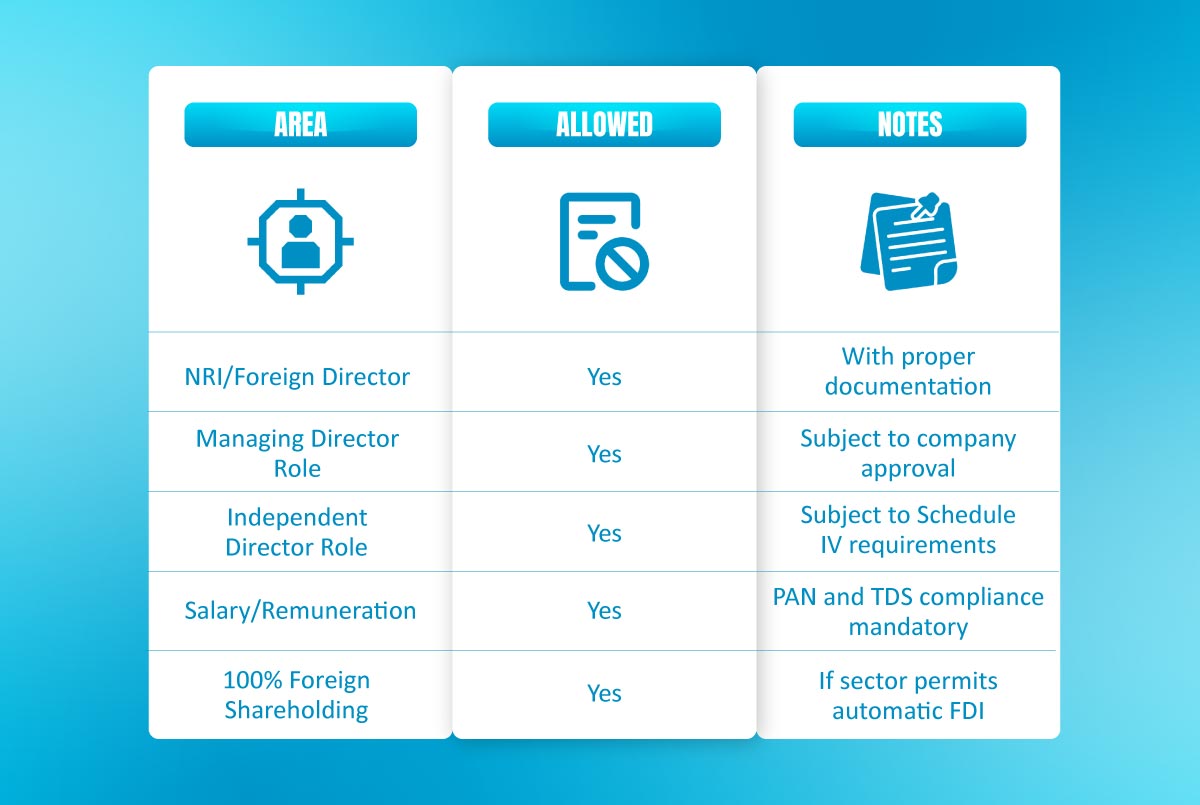

Summary Table

| Area | Allowed | Notes |

| NRI/Foreign Director | Yes | With proper documentation |

| Managing Director Role | Yes | Subject to company approval |

| Independent Director Role | Yes | Subject to Schedule IV requirements |

| Salary/Remuneration | Yes | PAN and TDS compliance mandatory |

| 100% Foreign Shareholding | Yes | If sector permits automatic FDI |

Frequently Asked Questions (FAQs)

1. Can an NRI be a Managing Director in India?

Yes. The company can appoint an NRI as MD with proper board approval and salary structure.

2. Can a foreigner own 100% of an Indian company?

Yes, under the automatic FDI route, this is permitted in most sectors.

3. What documents are needed for appointing a foreign director?

Passport, address proof, consent form, photograph, and certified DSC. Documents must be apostilled or consularized.

4. Can an NRI director receive salary?

Yes, provided PAN and TDS compliance is followed. Remuneration can be transferred abroad via FEMA-compliant methods.

5. Is PAN mandatory for a foreign director?

It is not mandatory for appointment but required for receiving any income from the company.

6. What is the TDS limit or rate for director payments?

For professional fees: 10% under Section 194J. For salary: as per slab under Section 192. Without PAN, 20% applies.

7. Can a foreign director be appointed remotely?

Yes. All documents can be sent digitally and certified properly — physical presence in India is not mandatory.

8. Can a foreign national act as an independent director?

Yes, subject to eligibility criteria and registration with the Independent Director databank.

9. Can an NRI invest in Indian startups or private companies?

Yes. They can invest as shareholders under the FDI route and also serve as directors.

10. Does every foreign investment require RBI approval?

No. Most sectors are under automatic route — RBI approval is only needed in restricted sectors.

NRI Company Registration in India

Easy NRI company registration in India – Powered by EbizFiling

About Ebizfiling -

February 20, 2026 By Prachi C

50+ Small Business Ideas for 2026 Introduction. Starting a business today is easier than before because technology, online tools, and changing customer habits have created many new opportunities. Many Small Business Ideas can be launchedwith low investment and simple setups. […]

February 20, 2026 By Bhakti S

Top 10 CS Firms in India – 2026 updated list Introduction Company Secretary firms play an important role by helping businesses manage professional compliance and regulatory requirements. Without proper CS support, companies may struggle to meet statutory obligations under […]

February 20, 2026 By Steffy A

Best Income Tax Software for Indian Taxpayers Introduction Filing Income Tax Returns (ITR) is a mandatory annual task for Indian taxpayers and often a stressful one. As per the Income Tax e-filing portal guidelines, taxpayers must submit their ITR […]