-

July 17, 2025

Decode the Password for Form 16A- for TDS deducted on income other than salary

What is Form 16A?

Form 16A is a TDS certificate issued by the Income Tax Department of India. It provides details of tax deducted at source on income like interest, rent, commission, or professional fees. It is essential for filing tax returns. Please note that the form 16A password is not applicable as it does not require a password for access.

- It is an acknowledgement receipt that states the tax that has been deducted from income other than salary by the employer and the same has been deposited with the Income Tax Department.

- Form 16A, just like Form 16 is a TDS certificate.

- Form 16A is issued when the TDS deduction is made for the income of fixed deposits in the bank or TDS deducted on insurance commission, TDS deducted on your rent receipts etc.

- Hence, Form 16A is issued when TDS is deducted on any other income you receive that is liable for such deduction.

- Form 16A, just like Form 16 contains the details of deductor and deductee, like name and address, details of PAN and TAN, also the amount of TDS deducted and deposited with the government.

- All details that are there in Form 16A are available on Form 26AS.

How to get Form 16A- TDS on income other than salary?

- It is mandatory for the person who deducts the TDS to issue TDS certificate in form 16A to the deductee.

- Form 16A can be downloaded from TRACES website. Once the deductor furnishes the details in Form 26AS and deposits the TDS, he or she can download Form 16A online.

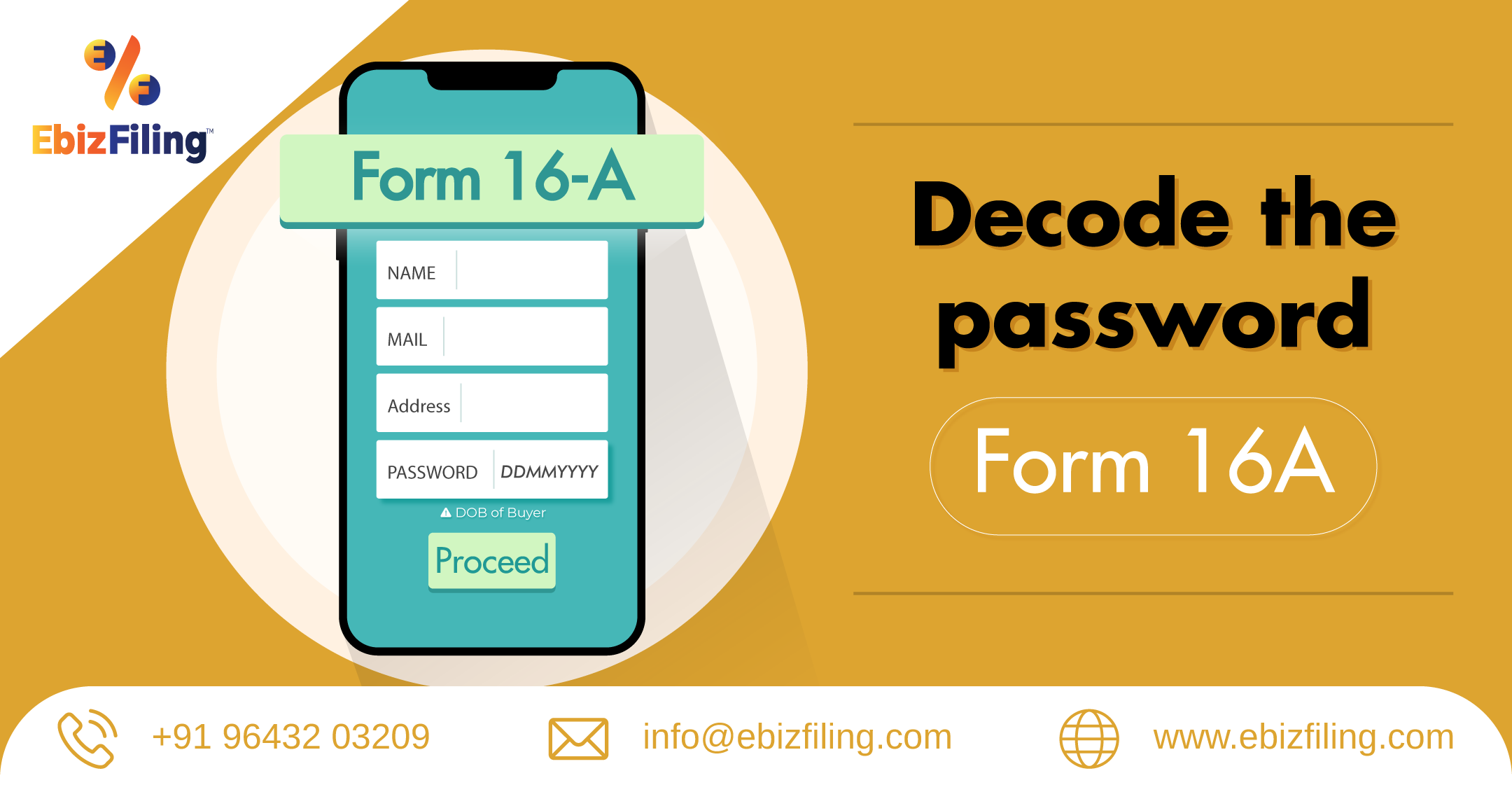

What is the Form 16A password?

- Form 16A is always password protected.

- The password for the Form 16A would be the first 5 characters of the PAN number in uppercase i.e. capital letters and Date of Birth of the employee in DDMMYYYY format.

- That means if your PAN number is BPTRA5997L and the date of birth is 11th November, 2000, then your password for Form 16A would be BPTRA11112000.

Form 16A is important as this form helps the taxpayers in filing their return smoothly. Form 16A also helps in verifying the income details and also the rate at which the TDS has been deducted. To avoid any sort of inconstancy when it comes to filing taxes, it is mandatory for the taxpayers to find out details about Form 16 and other Forms and use them accordingly.

Suggested Read :

Monthly GST Return Filing Due Date

TDS Return

File TDS return with Ebizfiling at affordable prices with Ebizfiling

About Ebizfiling -

Reviews

Ajit Gopal Pandit

20 Feb 2018Very efficient service to get yourself registered with your Business. Had a very good experience.

Deepika Khan

29 Sep 2018I would rate 5/5 for their services, pricing and transparency.

Janvi Seth

14 May 2018I wanted to register my business on E-commerce and my colleague suggested me Ebizfiling. I am glad we made the right choice of choosing them.

January 31, 2026 By Dhruvi D

Determining State Residency for Tax Purposes in the US Introduction Determining state residency for tax purposes is one of the most misunderstood areas of US taxation. Many taxpayers assume that where they live physically decides everything. In reality, states […]

January 30, 2026 By Dhruvi D

Key Federal Tax Credits and Deductions for US Taxpayers Begin With, Many US taxpayers pay more tax than required simply because they are not aware of available federal tax credits and deductions. These benefits are designed to reduce tax burden, […]

December 19, 2025 By Steffy A

Income Tax Department Cracks Down on Fake Party Fraud Introduction The has intensified scrutiny on income tax returns that show suspicious or unusually high refund claims. Recent investigations revealed the misuse of donations made to fake political parties and charitable […]