-

Entrepreneurship

-

July 24, 2025 By Zarana Mehta

Step by Step Process for setting up a Logistics Business in IndiaHow to Start a Logistic Company in India? Everything we use on a daily basis needs to be shipped and delivered to multiple locations before being sold and used, logistics is a big game both locally and worldwide. A Logistic […]

- नाम आरक्षण के क्या लाभ हैं?

- A complete guide on How to start your Car Rental Business in India?

- A guide on Performance and Credit Rating Scheme for MSME

- FAQs on LLP Strike off in India

-

-

Articles - Company Law

-

January 4, 2022 By Zarana Mehta

How to start a Trading Business for Food Items?A complete process on how to Set-Up a Food Trading Business in India Any food business must bear the obligation of supplying safe food and implementing hygienic preparation practices. The Food Safety and Standards Authority of India (FSSAI) has established […]

- All about the procedure to add a new co-founder for a Private Company

- નામ આરક્ષણના ફાયદા શું છે?

- A guide on Compulsory Share Transfer Provision

- Provisions for opening a Branch office of Nidhi Company

-

-

Articles - Company Law

-

November 23, 2021 By Zarana Mehta

How to start a Service-based Business in India?A complete guide to starting a Service-based Business in India If you want to register a startup or a new company in India, you must first register it with the Ministry of Corporate Affairs in India (MCA). It is not […]

- How to Surrender or Cancel Your TAN?

- PAN Card for Hindu Undivided Family under Hindu Law

- Tips for a Smooth Transition While Removing a Director

- ટ્રસ્ટ વાર્ષિક ફાઇલિંગમાં વ્યવસાયિક સહાયતાના લાભો

-

-

Articles - Company Law

-

December 21, 2022 By Zarana Mehta

Everything you need to know – “How to start a Sanitizer Manufacturing Business in India?”A complete process on “How to set up a Sanitizer Business in India?” Demand for hand sanitizer has skyrocketed as a result of Covid-19 because washing hands with an alcohol-based sanitizer kill the virus. In India, Pharmaceutical companies have to […]

- All about Transfer Pricing at arm’s length in India

- Important Statutory due dates for Company annual filing for FY 2019-20

- A guide on Form DIR-5 for Surrendering of DIN (Director Identification Number)

- Format of CS Certificate to be attached with FC-GPR

-

-

Other

-

March 8, 2025 By Sonali Sood

The Different Types of Graphic DesignsThe era of Graphic Designing We see graphics, banners, and logos almost everywhere when we look around. Graphic design can range from a sign at a local shop to a giant billboard poster for a well-known business. A graphic […]

- Signs Your Business Needs Legal Advisory Services

- Importance of Graphic Design in Digital Marketing

- India’s New Labour Code Reforms 2025: What Employers and Employees Must Know

- How to select a creative and unique Logo?

-

-

Income tax

-

November 11, 2021 By Zarana Mehta

Income Tax Annual Information Statement (AIS): Everything You Need to KnowAbout the Income Tax Annual Information Statement (AIS) The Income-Tax Department has released a new AIS (Annual Information Statement) that incorporates new categories of data such as dividends, interest, mutual fund transactions, international remittances, and securities transactions. This blog will […]

- All you need to know on Tax Audit Applicability for Traders

- A Comprehensive Guide to Section 43B of the Income Tax Act

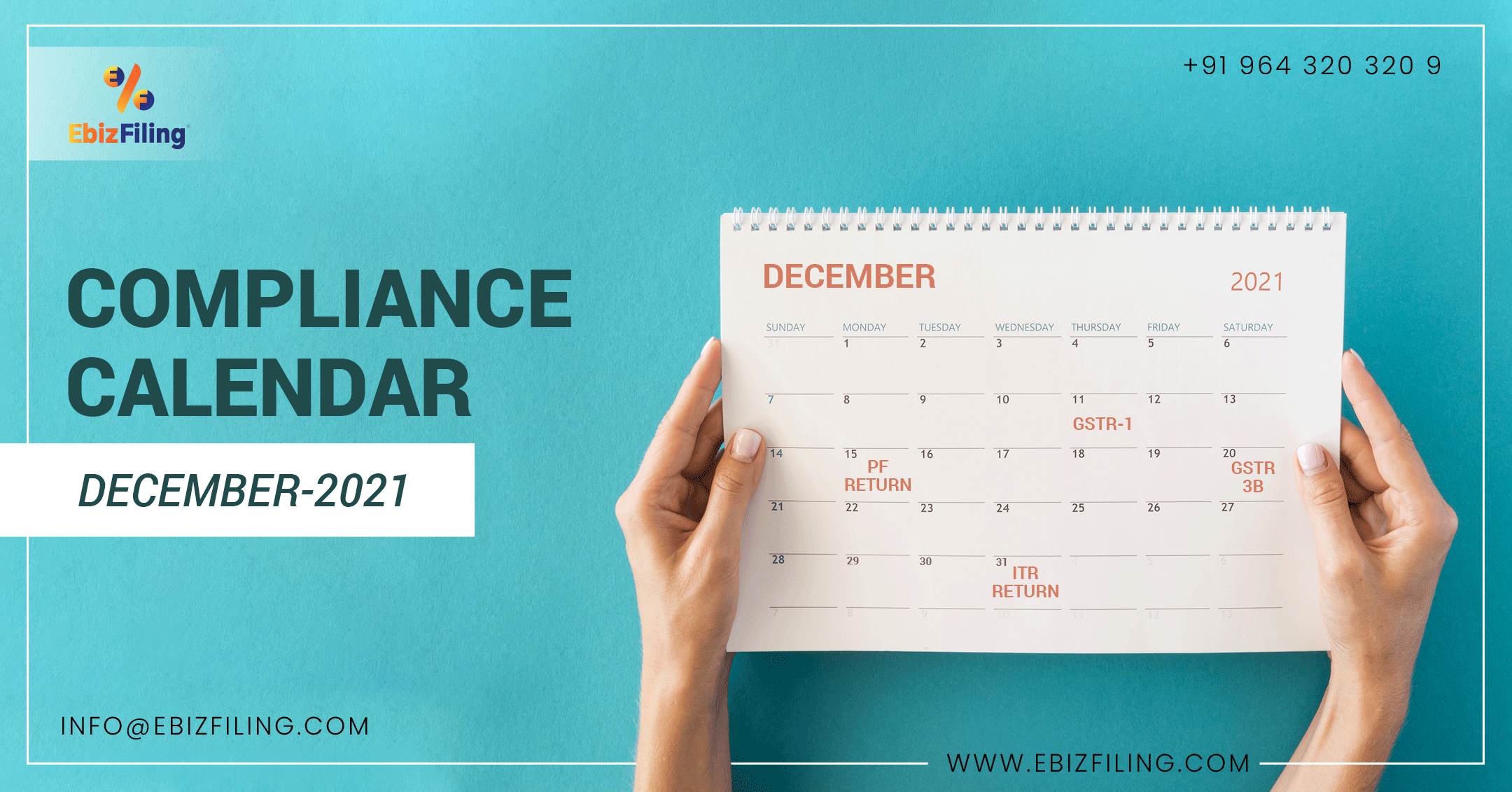

- Compliance Calendar for the Month of August, 2022

- All you need to know on Tax Treatment of a Foreign Company in India

-

Popular Posts

-

June 23, 2025 By Dharti Popat - Articles - Entrepreneurship

All you need to know about Surrender of IEC LicenseMany times it happens when one starts a business, fulfils all the necessary compliances, takes all the necessary registration required to start a business. But during the course of business, it happens that one needs to close a business or […]

-

February 26, 2026 By Dharti Popat - Company law, GST, Income tax

Tax Compliance and Statutory due dates of July 2021Compliance Calendar July 2021 Finally, the world is opening and everything is getting back in line after a long deadlock because of the COVID 19 crisis. However, it will take some time for the businesses, entrepreneurs and taxpayers to bounce […]

-

February 26, 2026 By Dharti Popat - Company law, GST, Income tax

Tax Compliance and Statutory due dates of September 2021Compliance Calendar September 2021 It is crucial for every business, irrespective of the business structure to adhere to the statutory compliance and complete all the necessary filings before the due dates. It is important to stay compliant with enormous compliance […]

About Ebizfiling -