-

February 14, 2026

-

BySteffy A

Income Tax Rules 2026: Major Renumbering of Income Tax Forms Explained

Introduction

The Income Tax Rules 2026 mark one of the biggest structural changes in India’s tax compliance system in recent years. From April 1, 2026, taxpayers and professionals will follow a new set of rules under the Income-tax Act, 2025.

One major highlight is the complete renumbering of income tax forms across audits, TDS, trusts, and reporting. Understanding these changes early will help businesses and professionals stay compliant and prepared.

Income Tax Rules 2026: What Is Changing and Why?

The Draft Income Tax Rules 2026 were released to support the implementation of the Income Tax Act, 2025. As per official releases and draft notifications, the government aims to simplify compliance and reduce confusion caused by legacy form numbering. Over the years, tax forms were introduced in phases. This created overlaps and inconsistencies. The new framework aligns form numbers logically with the structure of the new Act.

According to the draft rules, no change is proposed in filing responsibility; only the form numbers and structure are updated. This is a system-level change, not a new tax burden.

Overview of Form Renumbering

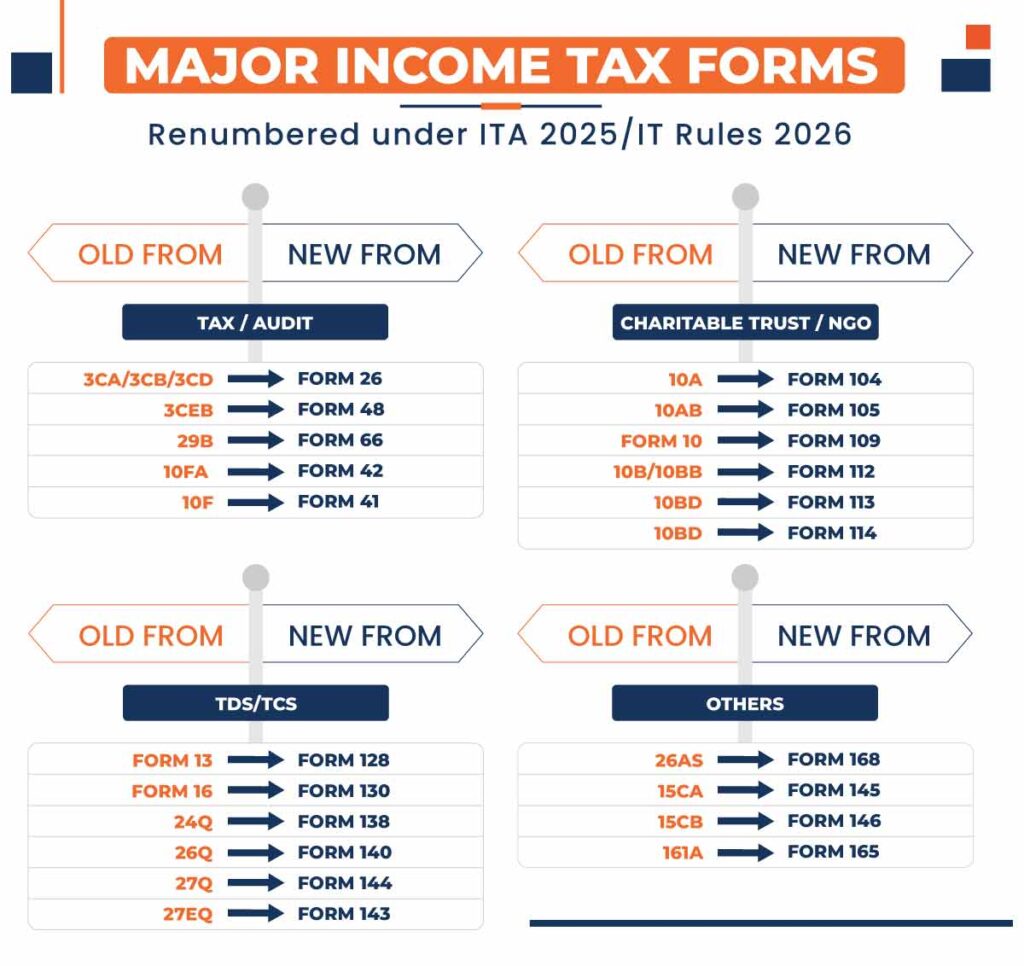

The infographic above shows how old income tax forms map to new form numbers under the Income Tax Rules 2026: http://www.incometax.gov.in/

Now let us understand each category in detail

Tax Audit and International Tax Forms

Under the new rules, audit and international tax reporting see major consolidation.

- Forms 3CA, 3CB, and 3CD are merged into Form 26

- Transfer pricing audit moves from Form 3CEB to Form 48

- MAT certification shifts from Form 29B to Form 66

- TRC application changes from Form 10FA to Form 42

- DTAA details move from Form 10F to Form 41

The Income Tax Rules 2026 consolidate audit reporting to reduce duplication and improve clarity in tax audit submissions.

Charitable Trust and NGO Compliance

Charitable institutions will see one of the biggest restructurings.

|

Purpose |

Old Form |

New Form |

|

Provisional Registration |

10A |

Form 104 |

|

Final Registration |

10AB |

Form 105 |

|

Income Accumulation |

10 |

Form 109 |

|

Audit Report |

10B / 10BB |

Form 112 |

|

Donee Statement |

10BD |

Form 113 |

|

Donor Certificate |

10BE |

Form 114 |

This mapping ensures better donation tracking and exemption monitoring under the Income-tax Act 2025.

TDS and TCS Reporting Forms

Withholding tax reporting also moves to a new structure.

- Form 13 becomes Form 128

- Form 16 becomes Form 130

- 24Q becomes Form 138

- 26Q becomes Form 140

- 27Q becomes Form 144

- 27EQ becomes Form 143

These changes support better analytics and real-time matching.

Other Important Reporting Forms

Several commonly used information forms are also renumbered.

- Form 26AS becomes Form 168

- Form 15CA becomes Form 145

- Form 15CB becomes Form 146

- Form 61A becomes Form 165

As per expert commentary, this improves data consistency across departments.

What Taxpayers and Professionals Should Expect?

The Income Tax Rules 2026 are still in draft stage and open for consultation. However, the transition date of April 1, 2026 is clearly defined. As seen in recent compliance reforms, early system readiness is key.

Professionals should plan internal training, software updates, and client communication well in advance.

How Does Ebizfiling Help You Prepare?

-

We continuously monitor updates under Income Tax Rules 2026 and share timely, accurate guidance with businesses and professionals

-

We help clients clearly understand old-to-new form mapping and explain how the changes impact audits, TDS, NGOs, and reporting

-

We assist in updating internal compliance checklists, filing processes, and documentation systems to match the new tax framework

-

We ensure a smooth and well-planned transition before April 2026 so clients avoid last-minute confusion or filing errors

Conclusion

The Income Tax Rules 2026 introduce a clear and structured compliance framework for the future. While the renumbering may look complex initially, it simplifies long-term filing and reporting.

Taxpayers and professionals who prepare early will avoid last-minute compliance stress. Staying informed is the first step toward smooth adaptation.

Suggested Read :

Income Tax Return (ITR )Compliance Calendar FY 2025 26

Union Budget 2026: New Updates and Highlights in Simple Language

Frequently Asked Questions on Income Tax Rules 2026

1. What are the Income Tax Rules 2026 and why were they introduced?

Income Tax Rules 2026 are draft rules issued to implement the new Income-tax Act, 2025. They aim to simplify compliance, align reporting formats, and remove confusion caused by outdated and overlapping tax forms.

2. From when will Income Tax Rules 2026 be applicable?

The new rules are proposed to come into force from April 1, 2026. Until then, existing Income-tax Rules will continue to apply for all filings and compliances.

3. Do Income Tax Rules 2026 change tax rates or slabs?

No, the rules do not change tax rates, slabs, or exemptions. They mainly focus on restructuring forms, reporting formats, and compliance procedures under the new tax law.

4. Why has the government renumbered income tax forms under the new rules?

The renumbering aligns tax forms with the structure of the Income-tax Act, 2025. This helps reduce duplication, improves clarity, and makes compliance easier for taxpayers and professionals.

5. Will taxpayers need to refile or revise old returns due to new form numbers?

No. Returns and reports filed before April 2026 using old forms remain valid. The new form numbers will apply only to filings made after the new rules become effective.

6. How will Income Tax Rules 2026 impact tax professionals and consultants?

Tax professionals will need to update their software, internal processes, and compliance checklists. Early preparation is important to avoid errors during the transition period.

7. Are charitable trusts and NGOs affected by Income Tax Rules 2026?

Yes. NGOs and charitable trusts will see major changes in form numbering for registration, audits, donor reporting, and income accumulation, though the compliance requirements remain the same.

8. What changes are introduced for TDS and TCS compliance under the new rules?

TDS and TCS forms like Form 16, 24Q, 26Q, and 27Q are renumbered to new formats. Filing frequency and due dates remain unchanged.

9. Does Form 26AS still exist under Income Tax Rules 2026?

Yes. Form 26AS continues to exist but is renumbered as Form 168. Its purpose as an annual tax statement remains unchanged.

10. Where can taxpayers verify official updates on Income Tax Rules 2026?

Taxpayers can verify all draft rules, notifications, and updates on the official Income Tax Department website at www.incometax.gov.in.

Income Tax Return Filing

File your income tax return in simple steps with Ebizfiling

About Ebizfiling -

March 3, 2026 By Steffy A

Companies Compliance Facilitation Scheme (CCFS-2026) Let’s Understand Many companies in India are currently facing heavy late filing penalties. If your company has not filed annual returns or financial statements on time, the additional fee continues to increase at ₹100 […]

February 24, 2026 By Steffy A

How to Start a Business When You Have No Ideas? Introduction Many people want to start a business but struggle because they don’t know what business idea to choose. If you feel stuck, you are not alone. The truth […]

February 24, 2026 By Steffy A

Why More Startups Prefer Online Business Support? Introduction Startups today operate in a fast-moving digital environment where speed, flexibility, and smart resource management matter more than ever. Traditional business support models often involve higher costs, manual processes, and slower […]