New MSMe definition as per Atma Nirbhar Bharat Abhiyan

On 13th may, 2020 Government of India announced some major relief to the MSMEs. And one of the major relief is that the Government Revised the definition of the MSMe as a whole.

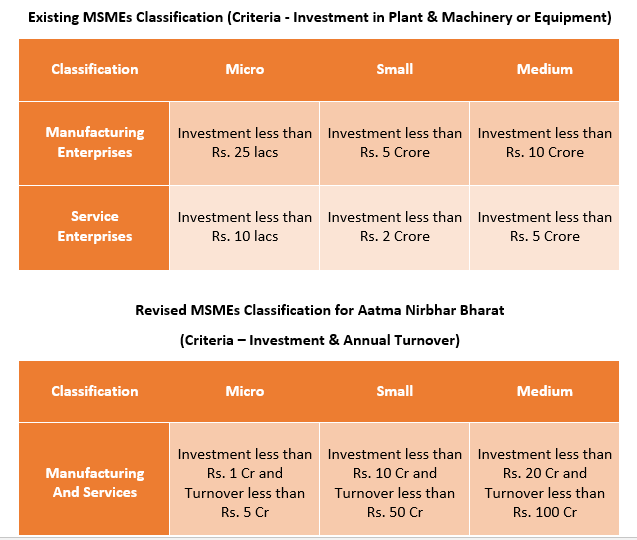

Under the new definitions, the distinction between manufacturing and services enterprises has been eliminated and the investments have been revised upwards and an additional criteria of turnover has been introduced.

What is the new & Revised definition of MSMe?

The new definition of MSMe is as follows:

Micro Enterprise: Manufacturing and services enterprises with investments up to Rs 1 crore and turnover up to Rs 5 crore will be classified as micro enterprises.

Small Enterprise: For small enterprises, the investment criteria and the turnover criteria has been revised upwards to Rs 10 crore and Rs 50 crore respectively

Medium Enterprise: Enterprises with investment up to Rs 20 crore and turnover up to Rs 100 crore will be termed as medium enterprises.

The new definition will benefit all the MSMes as they need not worry about growing in size; they will still be able to get quite a lot of benefits which otherwise, as an MSME, they have got.

Benefits of SSI or MSME Registration

The Indian government has provided many benefits for small-scale units or medium small and micro enterprises (MSME). In order to be eligible to get these benefits, any entity should register itself as MSME/SSI enterprise under the MSMED Act., MSME Registration is a must to avail these below mentioned benefits and proprietorship firm , Partnership firm, Private Limited Company’s, Limited Liability Partnership (LLP) can also register under MSMED Act.

Following is a list of such benefits of obtaining SSI/MSME registration in India.

-

Collateral Free loans from banks

The Credit Guarantee Fund Scheme for Micro and Small Enterprises (CGS) was launched by the GOI to make available collateral-free credit to the micro and small enterprise sector. Both the existing and the new enterprises are eligible to be covered under the scheme. The Ministry of Micro, Small and Medium Enterprises, Government of India and Small Industries Development Bank of India (SIDBI), established a Trust named Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) to implement the Credit Guarantee Fund Scheme for Micro and Small Enterprises.

-

A hefty 50% subsidy on Patent registration

Enterprises that have MSME Registration Certificate can avail 50% subsidy for patent registration by making application to respective ministry.

-

1% exemption on the interest rate on overdraft

Enterprises that have MSME Registration can avail the benefit of 1% exemption on the interest rate on OD as mentioned in the scheme (this is bank-dependent).

-

Eligible for Industrial Promotion subsidy

Enterprises that have MSME Registration are eligible for Industrial Promotion Subsidy as may be prescribed by the government in this behalf.

-

Protection against delayed payments

The Ministry of Micro, Small and Medium Enterprises gives protection to MSME Registered Business against a delay in payments from Buyers and right of interest on delayed payment through conciliation and arbitration and settlement of dispute be done in minimum time. If any micro or small enterprise that has MSME registration, supplies any goods or services, then the buyer is required to make payment on or before the date agreed upon between the buyer and the micro or small enterprise. In case there is no payment date on the agreement, then the buyer is required to make payment within fifteen days of acceptance of goods or services. Further, in any case, a payment due to a micro or small enterprise cannot exceed forty-five days from the day of acceptance or the day of deemed acceptance. In case of failure by the buyer to make payment on time, the buyer is required to pay compound interest with monthly interest rests to the supplier on that amount from the agreed date of payment or fifteen days of acceptance of goods or service. The penal interest chargeable for delayed payment to an MSME enterprise is three times of the bank rate notified by the Reserve Bank of India.

-

Concession in electricity bills

Enterprises that have MSME Registration Certificate can avail Concession on electricity bill by making application to the electricity department along with MSME Registration Certificate.

-

Reimbursement of ISO Certification charges

Enterprises that have MSME Registration Certificate can claim reimbursement of ISO Certification expenses by making application to respective authority.

-

Excise Exemption Scheme

Enterprises that have MSME Registration can enjoy Excise Exemption in the initial year of business, as mention in the Excise Exemption scheme by Government and depending on business activity.

-

Very easy to get Licenses, approvals and registrations

It has made very easy for enterprises that are having MSME Certificate to obtain Licenses, approvals and registrations on any field for their business from the respective authorities as they can produce the Certificate of MSME Registration while making application.

-

Exemption under Direct Tax Laws

Enterprises that have MSME Registration can enjoy Direct Tax Exemption in the initial year of business, as mention in the scheme by Government and depending on business activity.

Micro, Small & Medium Enterprises explained in easy language-Learn more here

SSI / MSME / Udyog Aadhaar registration

About EbizFiling.com :

EbizFiling.com is a motivated and progressive concept conceived by like-minded people, which helps small, medium and large businesses to fulfill all compliance requirements of Indian Laws. It is a platform managed, operated and driven by CA, CS, IT professionals, Lawyers, and Influencers, who have vast experiences into the respective fields. What differentiates us from others is our pricing, TAT, dedicated teams of professionals, whom we call Compliance Managers, digitally advanced platforms for client serving, among other things. Internally at EbizFiling, we have developed unique and customized working methods, which are committed to ensuring error-free service delivery, faster execution and quick response time to the clients.

Get in touch for a free consultation on info@ebizfiling.com or call 9643203209.

Hi Arun,

Thanks for writing to us. Please share your detailed query on info@ebizfiling.com. Team will get in touch with you soon.