-

February 8, 2022

Table of Content

Amnesty Scheme for Condonation of delay- Now Applicable to LLPs as well

LLP annual filings

Every Limited Liability Partnerships (LLPs) is required to file its annual return within 60 days from the end of the financial year and Statement of Account & Solvency within 30 days from the end of six months of the close of the financial year.

Be compliant by filing your LLP Annual filing with Ebizfiling before the due date.

Apart from this, Information with regard to any change in LLP agreement is required to be filed within 30 days of such change with ROC. Also, Notice of appointment, cessation, change in name/ address/designation of a designated partner or partner, and consent to become a partner/designated partner shall be filed with ROC in Form 4 within 30 days of such appointment/cessation, as the case may be.

Earlier If there was a delay in filing Form 8 and Form 11 of LLP, a penalty of Rs. 100 per day per form was payable from the due date of filing return till the date the actual return is filed.

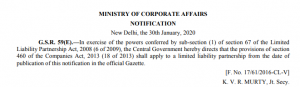

MCA vide its recent Notification has now extended the provisions of Section 460 to LLPs which would mean that now Limited Liability Partnerships also have the option of proceeding before the Central Government on account of any delay in filing an application/ document with the Central Government or Registrar respectively. That means the penalties for late filing fees of LLP Form 3, Form 8, and Form 11 may be condoned after recording the reasonable reason in writing.

Condonation of delay- Section 460 of the Companies Act:

Condonation of Delay is a Scheme to provide one final opportunity to the directors of the defaulting companies who due to the reason of the non-filing of financial statements and annual returns were held liable and disqualified.

Earlier while this privilege was available to companies only, with the latest notification issued by MCA this directive will be applicable to LLPs also, meaning thereby, directors of LLPs will now get the benefit of condoning the delay.

See the Notification on Amnesty Scheme for Condonation of Delay for LLPs below:

Let’s study what Section 460 of the Companies Act has to say in this regard

Section 460 under the Companies Act 2013, states,

- Where any application required to be made to the Central Government under any provision of this Act in respect of any matter is not made within the time specified therein, that Government may, for reasons to be recorded in writing, condone the delay; and

- Where any document required to be filed with the Registrar under any provision of this Act is not filed within the time specified therein, the Central Government may, for reasons to be recorded in writing, condone the delay.

Late fees for LLP filings will be reduced

The scheme will allow those who have not filed LLP forms 3 and 4 as well as forms 8 and 11 to file the returns with an additional fee of Rs 10 a day with an overall cap of Rs 5,000. Currently, for each day of delay in filing any of these forms, the penalty is Rs 100 a day.

Know: The important Statutory due dates for LLP Annual filings

The move is meant to make life easier for businesses and help them cure problems that they may be facing due to the non-filing of returns. It’s a great step to prevent the miscarriage of justice taken by the ministry to condone the delay when the delay is occasioned for the reason beyond the control until the lawbreakers don’t take advantage of it.

About Ebizfiling -

April 22, 2024 By Team Ebizfiling

MSME Registration Fees: Recognizing the Relevant Charges Registration with the relevant authorities is necessary to receive the benefits and incentives offered to MSMEs. Entrepreneurs, however, frequently want clarification on MSME registration fees. The intricacies of MSME registration charges are explored […]

April 19, 2024 By Team Ebizfiling

Frequently Asked Questions (FAQs): A Guide to Understanding Form 15CA and Form 15CB The Indian Income Tax Department requires Forms 15CA and 15CB to facilitate overseas transactions and guarantee that tax requirements are followed. Remittances from Indian citizens to non-residents […]

April 15, 2024 By Team Ebizfiling

Comprehending Taxation and Compliance for Transport Business Startup Understanding taxation and compliance is not just necessary, but crucial for entrepreneurs considering launching a transportation business. Before you understand how to start a travel business in India, you should read the […]