-

Company law

-

February 4, 2025 By Dharti Popat

How to Appoint a Director in a Pvt Ltd Company?How to Appoint a Director in a Pvt Ltd Company?And What are the Provisions and Process? Introduction A Private Limited Company needs at least two directors to manage and oversee its operations. The board of directors can appoint a director […]

- LLP Strike off with inactive bank accounts

- A guide on Form DIR-5 for Surrendering of DIN (Director Identification Number)

- How to start a Trading Business for Food Items?

- MOA: Common Disputes and their Solutions

-

-

Uncategorized

-

April 14, 2021 By Dharti Popat

All you should know about GST Changes effective from 01.04.2021Major Changes in GST effective from 1st April 2021 – All you should know about GST Changes Goods and service tax in India has made a couple of changes that are applicable from the 1st of April, 2021. The changes […]

- Transitioning to Digital Accounting

- Difference Between Authorized Capital and Dividend Distribution

- CIN નો ઉપયોગ કરતી વખતે ટાળવા માટેની ભૂલો

- GST LUT चालान और लेखांकन को कैसे प्रभावित करता है?

-

-

One Person Company

-

December 30, 2021 By Dharti Popat

ROC Compliance Calendar 2021-22ROC filing Due Dates falling in the year 2021-22 All the business structures registered in India i.e. Private Limited Company, Public Limited Company, One Person Company, Limited Liability Partnership etc need to file certain forms every year with the Registrar […]

- Advantages and Disadvantages of an OPC (One person Company)

- ROC Filing Due Dates for the Year 2022-23

- Tax Compliance and Statutory due dates for the month of November, 2021

- ROC Compliance Calendar 2023-24 (FY 2022-23)

-

-

Limited Liability Partnership

-

May 17, 2022 By Dharti Popat

Important Statutory due dates for LLP Annual Filing FY 2020-21A compilation of all the ROC (LLP) Filing Due dates for Financial Year 2020-21 (AY 2021-22) A Limited Liability Partnership is a business structure that requires a minimum number of two members and there is no limit on the maximum […]

- ROC Filing Due Dates for the Year 2022-23

- Formalities required for a partner exiting an LLP that is in debt

- ROC Compliance Calendar 2021-22

- Tax Compliance and Statutory due dates for the month of May, 2021

-

-

Company law

-

December 30, 2021 By Dharti Popat

Important Statutory due dates for Company annual filing for FY 2020-21A compilation of all the ROC (Company) Filing Due dates for Financial Year 2020-21 (AY 2021-22) As soon as the new financial year starts, it is important for a company be it a Private Limited Company or a Public […]

- ROC શોધ અહેવાલ: FAQs

- Revised DIR-2 Form Format

- Difference Between Increasing Authorized Capital & Share Buybacks

- UAN Guide, UAN Registration Process & “How to activate UAN in EPFO?”

-

-

Company law

-

April 3, 2021 By Dharti Popat

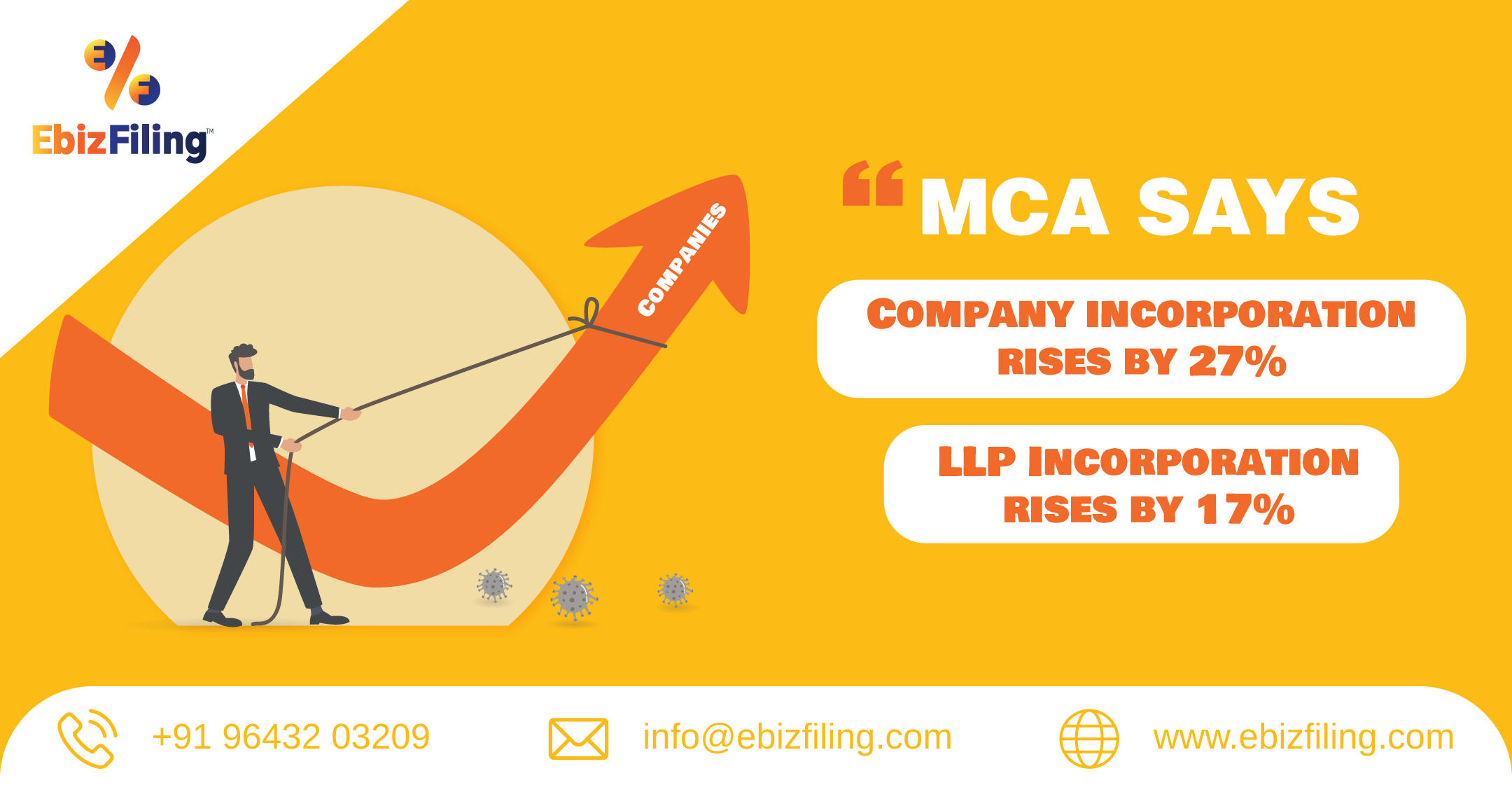

LLP (17%) & Company Incorporation (27%) rises in FY 2020-21- MCAMCA: Year on Year in FY 2020-21, Company Incorporation increased by 27%, LLP Incorporation by 17% Financial Year 2020-21 has been very crucial for everybody. A lot of businesses has failed due to the lockdown given because of the COVID […]

- Modified guidelines for other service providers (OSPs)

- FAQs on Companies Fresh Start Scheme 2020

- All about Entrenchment in Articles Of Association

- Difference between TIN, TAN, VAT, PAN, DSC, and DIN

-

Popular Posts

-

June 23, 2025 By Dharti Popat - Articles - Entrepreneurship

All you need to know about Surrender of IEC LicenseMany times it happens when one starts a business, fulfils all the necessary compliances, takes all the necessary registration required to start a business. But during the course of business, it happens that one needs to close a business or […]

-

December 29, 2025 By Dharti Popat - Company law, GST, Income tax

Tax Compliance and Statutory due dates for the month of July, 2021Compliance Calendar for the month of July 2021 Finally, the world is opening and everything is getting back in line after a long deadlock because of the COVID 19 crisis. However, it will take some time for the businesses, entrepreneurs […]

-

December 29, 2025 By Dharti Popat - Company law, GST, Income tax

Tax Compliance and Statutory due dates for the month of September, 2021Compliance Calendar for the month of September 2021 It is crucial for every business, irrespective of the business structure to adhere to the statutory compliance and complete all the necessary filings before the due dates. It is important to stay […]

About Ebizfiling -