-

October 2, 2021

Table of Content

GSTR-4, Quarterly return filing under composition Scheme

Filing of returns under GST can be a hectic and tiresome work. However as GST return filings are mandatory, experts at Ebizfiling have worked on this article to help you understand everything about GSTR 4 for GST composition Scheme. This form is to be filed by the ones registered under Composition scheme.

WHo can opt for Composition scheme under GST?

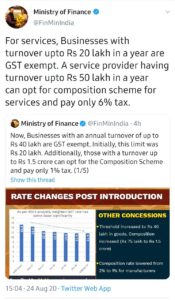

According to the latest update, the businesses with a turnover up to Rs 1.5 crore can opt for the Composition Scheme and pay only 1% tax. Also, service provider having turnover up to 50 lakhs can opt for composition scheme for services and pay only 6% of tax.

Under the composition scheme, the composition dealer cannot issue a tax invoice meaning, he/she cannot charge tax from customers. The dealer needs to issue a Bill of Supply. The main advantage of opting the composition scheme is that there are lesser compliances as only quarterly returns are required to be filed, example GST4. The due date for filing Form GSTR-4 is 18th of the month succeeding the quarter or as extended by Government from time to time. For the quarter of April to June 2019 the Due Date is 18th July 2019. Even in case of a nil return, GSTR4 is required to be filed. However, an annual return GSTR-9A is also required to be filed on or before 30th June 2019 for F.Y 2017-18.

Due dates for filing GSTR-4 returns for F.Y 2019-20

| Period (Quarterly) | Due Dates |

| 1st Quarter April to June 2019 | 18th July 2019 |

| 2nd Quarter July to September 2019 | 18th October 2019 |

| 3rd Quarter October to December 2019 | 18th January 2020 |

| 4th Quarter January to March 2020 | 18th April 2020 |

Late fees for not filing the GSTR 4 within the due date

If a taxpayer does not file his/her return within the due dates mentioned above, he/she shall have to pay a late fee of Rs. 50/day i.e. Rs. 25 per day in each CGST and SGST (in case of any tax liability) and Rs. 20/day i.e. Rs. 10/- day in each CGST and SGST (in case of Nil tax liability) subject to a maximum of Rs. 5000/-, from the due date to the date when the returns are actually filed.

Modes of signing the Form GSTR-4 for GST Composition Scheme.

Digital Signature Certificate (DSC)

Digital Signature Certificates (DSC) are the digital equivalent (that is electronic format) of physical or paper certificates. A digital certificate can be presented electronically to prove one’s identity, to access information or services on the Internet or to sign certain documents digitally. In India, DSC is issued by authorized Certifying Authorities.

Electronic Verification Code (EVC)

The Electronic Verification Code (EVC) authenticates the identity of the user at the GST Portal by generating an OTP. The OTP is sent to the registered mobile number of Authorized Signatory filled in part A of the Registration Application.

GST Registration

Get GST Registration with Ebizfiling at Affordable Prices.

About Ebizfiling -

Reviews

Amir Abbas Sayedrizvi

05 Aug 2019Charges are very affordable and One of the fastest & bestest service I ever get and miss Snehal is too corporative and very dedicated I had recommended to all my colleagues even they also like thier services.

Janvi Seth

14 May 2018I wanted to register my business on E-commerce and my colleague suggested me Ebizfiling. I am glad we made the right choice of choosing them.

Peoplestrat

16 Mar 2019Well coordinated effort to file our first GST return. Thanks to the team.

April 2, 2024 By Team Ebizfiling

Compliance Calendar For The Month of April 2024 As the new financial year begins in April, businesses and taxpayers around the country have new opportunities and responsibilities. It provides an excellent opportunity for strategic planning and budgeting, allowing businesses to […]

March 9, 2024 By Dharmik Joshi

Frequently Asked Questions on the GSTR 1 Form Introduction The Goods and Services Tax (GST) has significantly transformed India’s taxation landscape. Among the various GST forms, GSTR 1 holds a pivotal place. It is a return form that necessitates the […]

March 2, 2024 By Siddhi Jain

What are the reasons for GST Cancellation & how to avoid them? Introduction The Goods and Services Tax (GST) has drastically changed the tax structure for Indian Companies. However, it’s important to realize that keeping a GST registration current involves […]