-

Articles - Company Law

-

November 22, 2025 By Team Ebizfiling

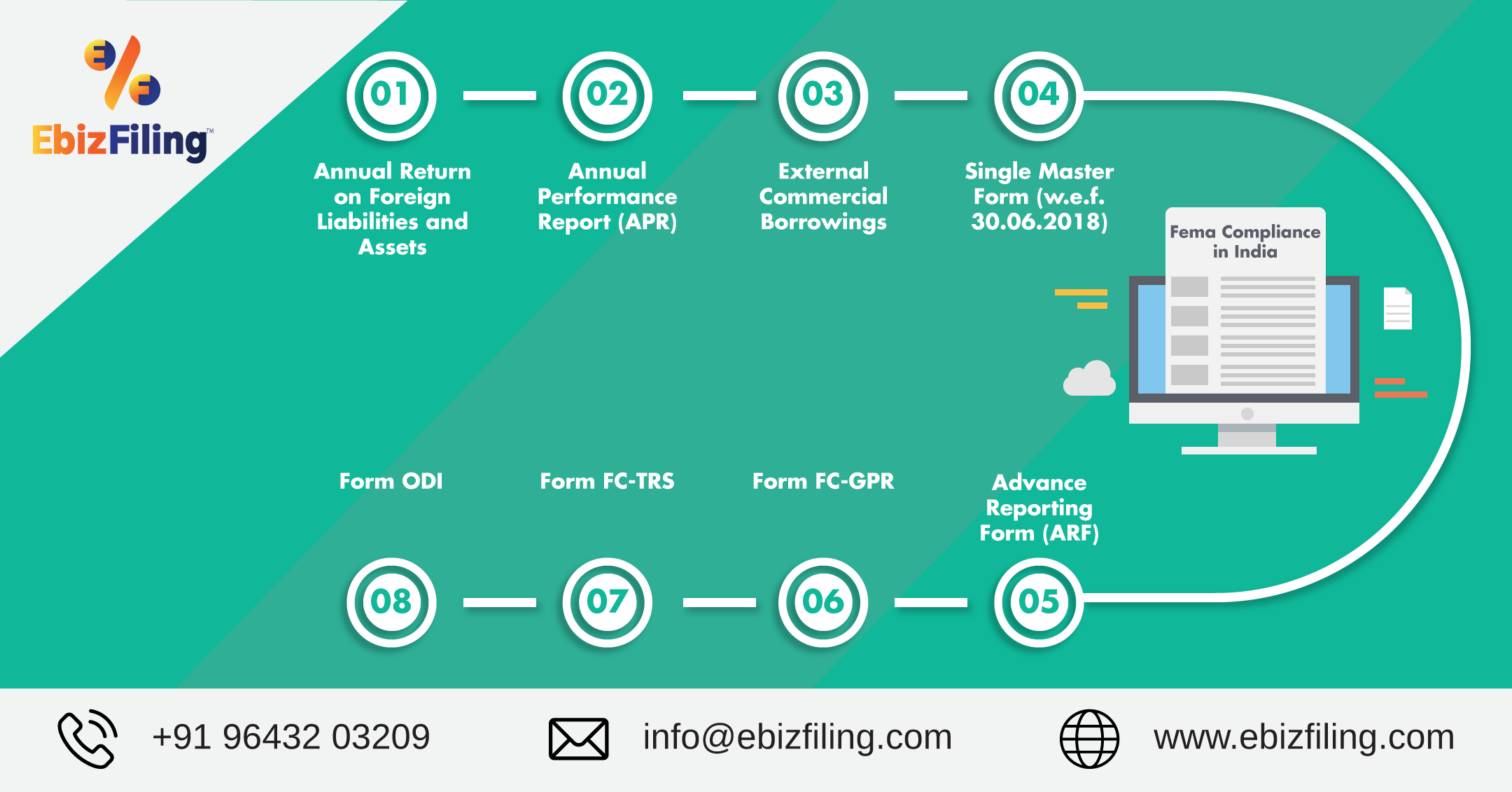

FEMA Compliance in IndiaFEMA Compliance in India : Guidelines, Requirements, Benefits, Documents Required, criteria Introduction Established in 1999 to replace the Foreign Exchange Regulation Act (FERA), FEMA was introduced to align India’s foreign exchange rules with economic liberalization. It regulates foreign exchange use and […]

- चल संपत्ति पर शुल्क पंजीकरण के लाभ और जोखिम?

- How to start an IT startup in India?

- MCA Extends deadline for Holding AGM for FY 2019-20 till 31st December, 2020.

- DIN માટે અરજી કરતી વખતે ટાળવા માટેની 6 સામાન્ય ભૂલો

-

-

Articles - Company Law

-

September 13, 2025 By Team Ebizfiling

XBRL Filing in IndiaWhat is XBRL? XBRL is a language for e-communication of financial and business data for business reporting. It is a standardized communication language in the electronic form to express, report, or file financial statements by Companies. However, XBRL is only […]

- Issues related to Patent Registration in India

- All you need to know about compliance requirement of Trust in India

- How to start a trading business of goods and product?

- Steps for Offshore Company Setup Successfully

-

-

Articles - Company Law

-

July 14, 2025 By Team Ebizfiling

Union Budget 2019-20 Highlights presented on 5th July 2019Union Budget 2019-20 Highlights presented on 5th July 2019 The Union Minister for Finance and Corporate Affairs Smt. Nirmala Sitharaman made her maiden Budget Speech on 5th July,2019 and presented the Union Budget 2019-20 before the Parliament. As expected the […]

- DIR-3 KYC with Reduced Fee of Rs. 500 can be filed upto 5th October 2018

- INC 20A Commencement of Business Certificate late fees explained

- Key features of SPICe+ (Pronounced as SPICe plus)

- Clauses Of Memorandum of Association (MOA)

-

-

Articles - Company Law

-

June 8, 2022 By Ravi

MCA Form DIR 3 KYC extension to 15th October 2019DIR 3 KYC Extension likely As per sources, we have come to know that MCA has already extended the due date of filing DIR 3 KYC for directors. The due date has been extended to 15th October 2019 from […]

- Why do you need an ROC search report for due diligence?

- How to start a trading business of goods and product?

- What Are The Recent Changes in Form INC 20A?

- MCA extends various Due Dates to 31st December 2020- CFSS 2020 and LSS included

-

-

Articles - Tradmark

-

January 28, 2025 By Team Ebizfiling

Trademark Watch Services In IndiaTrademark Watch Services in India Introduction Trademark Watch Services in India are essential tools for businesses to protect their brand identity. These services monitor the registration of new trademarks to ensure that no similar marks are filed by others, which […]

- Types of Trademarks that can be registered in India

- Trademark Class 27: Floor Coverings and Artificial Ground Coverings

- Trademark registration services in Hyderabad

- Trademark Class 30: Coffee, Tea, Cocoa, Sugar, Rice, Tapioca, Sago, Artificial Coffee

-

-

Articles - GST

-

July 17, 2025 By Team Ebizfiling

Online Process to Change GST of AddressOnline Process to Change GST of Address Introduction GST registration with a change in address involves updating the Goods and Services Tax (GST) records when a business relocates. Businesses are required to notify the GST authorities by submitting an amendment […]

- SAC Code and GST Rate on Legal, Accounting and Professional Services

- Highlights of 33rd GST Council Meeting dated 24th Feb 2019

- Highlights of 14th GST Council Meeting dated 18th May 2017

- GST Compensation Cess on Cars

-

Popular Posts

-

June 23, 2025 By Dharti Popat - Articles - Entrepreneurship

All you need to know about Surrender of IEC LicenseMany times it happens when one starts a business, fulfils all the necessary compliances, takes all the necessary registration required to start a business. But during the course of business, it happens that one needs to close a business or […]

-

December 29, 2025 By Dharti Popat - Company law, GST, Income tax

Tax Compliance and Statutory due dates for the month of July, 2021Compliance Calendar for the month of July 2021 Finally, the world is opening and everything is getting back in line after a long deadlock because of the COVID 19 crisis. However, it will take some time for the businesses, entrepreneurs […]

-

December 29, 2025 By Dharti Popat - Company law, GST, Income tax

Tax Compliance and Statutory due dates for the month of September, 2021Compliance Calendar for the month of September 2021 It is crucial for every business, irrespective of the business structure to adhere to the statutory compliance and complete all the necessary filings before the due dates. It is important to stay […]

About Ebizfiling -