-

Entrepreneurship

-

May 4, 2022 By Zarana Mehta

What is Startup India Scheme? And Information on Startup India PortalEverything you need to know about Startup India Scheme and Startup India Portal In this article information on Startup entrepreneurs, Startup India scheme, Startup ideas in India, Startup Companies in India, Startup Funding India, E startup India, Unicorn Startup India, […]

- Director Identification Number: Importance of DIN and How to apply for DIN?

- The Legal Checklist for Issuing ESOPs in India

- How ESOPs Are Taxed in India: A Simple Guide for Employees

- What is an ESOP? A Simple Guide for Startups & Pvt Ltd Companies

-

-

FAQs

-

June 20, 2024 By Zarana Mehta

All about Dormant Company under Company Act, 2013Dormant Company under Company Act, 2013 and Why to Obtain Dormant Status? Introduction A dormant company is a company that has been formed and registered but has not made any important financial transactions. It may be kept for future […]

- Filing Forms GNL-2 and MGT-14

- In July 2018,a Company Got Converted into LLP,When will it file its first ROC Return?

- FAQs on Provisional Patents

- Complete Guide to Ebizfiling Payment Options

-

-

Articles

-

May 28, 2022 By Zarana Mehta

A complete guide on Patent and 4 types of Patent Application in India4 types of Patent Applications in India and Advantages of Patent Registration in India Patents offer an entity exclusive rights to a product or procedure after it has been discovered, innovated, or invented. Public disclosure of your idea via a […]

- Roles of content promotion in SEO writing

- Expectations from Budget 2020- What Different Classes of people Expects

- Income tax Rates Slab for FY 2018-19 or AY 2019-20

- Implications of Voice Search on SEO & Digital Marketing

-

-

Limited Liability Partnership

-

February 18, 2025 By Zarana Mehta

LLP Annual Filing, Process for LLP E-filing and Due DatesLLP Annual Return Filing, Process for LLP E-filing, and LLP Filing Due Dates Introduction A Limited Liability Partnership (LLP) is a distinct legal entity, registered with the Ministry of Corporate Affairs (MCA). You can fulfill this requirement by completing the [...]

- Formalities required for a partner exiting an LLP that is in debt

- Mandatory Compliance for a Limited Liability Partnership in India

- A complete guide to LLP Registration in Rajasthan

- Important Statutory due dates for LLP Annual Filing FY 2020-21

-

-

FAQs

-

September 23, 2025 By Zarana Mehta

All you need to know on Conversion of Partnership to Private Limited CompanyProcess on Conversion of a Partnership Firm to Private Limited Company Do you want to convert your Partnership Firm to a Private Limited Company? This article will help you in clearing your thoughts related to the conversion of a Private […]

- Can a Sole Proprietorship Be Pvt Ltd? How to Convert?

- What is a Partnership Firm?

- Advantages of Pvt Ltd Company Startup

- Business Plan Preparation and How to make a Perfect Business Plan?

-

-

FAQs

-

September 26, 2025 By Zarana Mehta

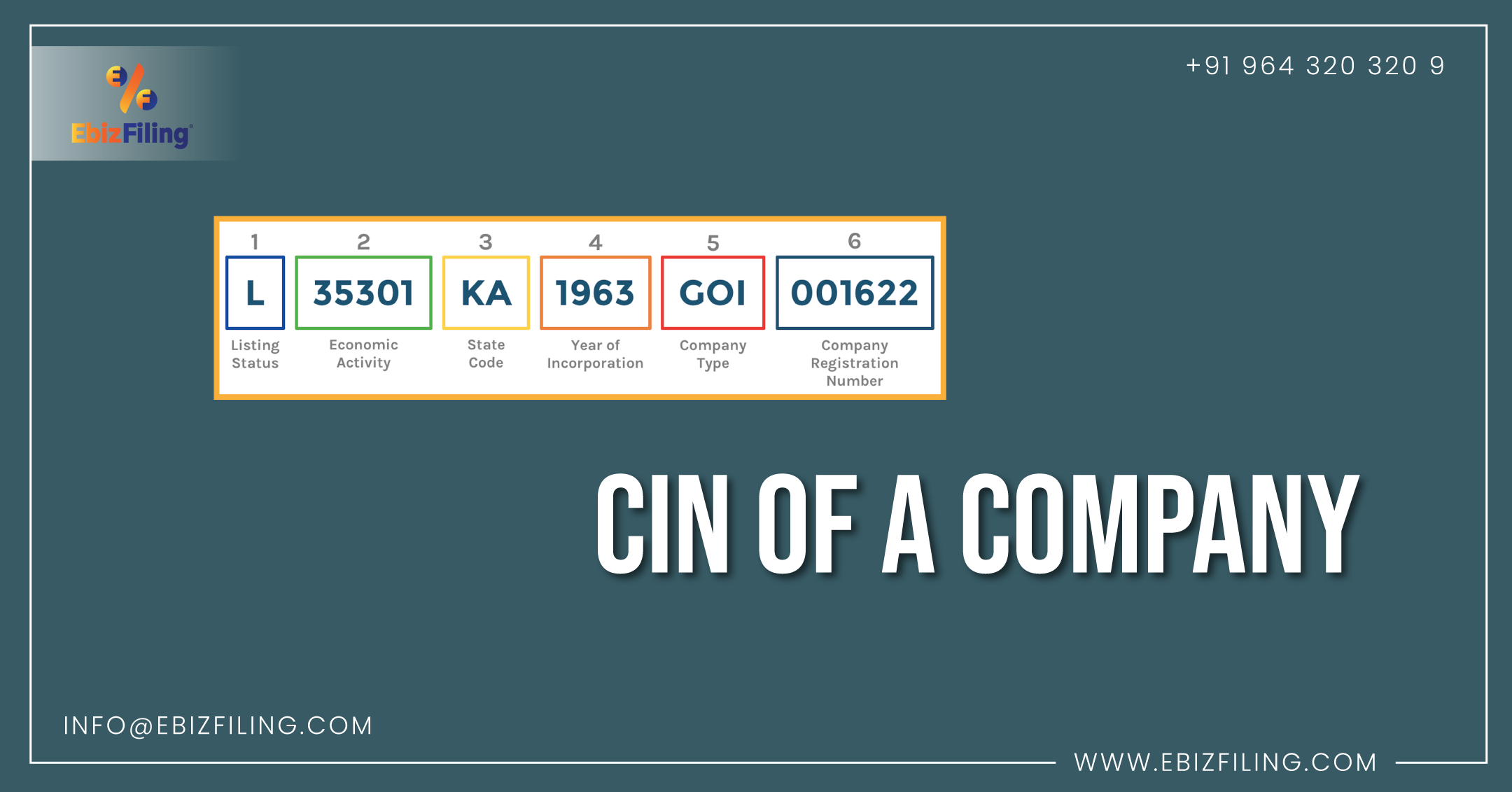

What Is CIN (Corporate Identification Number) of a Company?CIN Number of a Company: Meaning, Registration & How to Check It Introduction This blog includes information on the CIN number for a company, what a CIN number is, how to register and check a CIN number, and other relevant […]

- 28 Frequently Asked Questions (FAQs) on SPICe+ Form

- Filing Forms GNL-2 and MGT-14

- FAQ’s Shifting of forms from MCA V-2 to MCA V-3 Portal

- All about Dormant Company under Company Act, 2013

-

Popular Posts

-

June 23, 2025 By Dharti Popat - Articles - Entrepreneurship

All you need to know about Surrender of IEC LicenseMany times it happens when one starts a business, fulfils all the necessary compliances, takes all the necessary registration required to start a business. But during the course of business, it happens that one needs to close a business or […]

-

February 26, 2026 By Dharti Popat - Company law, GST, Income tax

Tax Compliance and Statutory due dates of July 2021Compliance Calendar July 2021 Finally, the world is opening and everything is getting back in line after a long deadlock because of the COVID 19 crisis. However, it will take some time for the businesses, entrepreneurs and taxpayers to bounce […]

-

February 26, 2026 By Dharti Popat - Company law, GST, Income tax

Tax Compliance and Statutory due dates of September 2021Compliance Calendar September 2021 It is crucial for every business, irrespective of the business structure to adhere to the statutory compliance and complete all the necessary filings before the due dates. It is important to stay compliant with enormous compliance […]

About Ebizfiling -