-

July 14, 2025

Compulsory Late filing fees on Income Tax Returns-Read to understand if this applies to you

Important Update- Due date for Income Tax Return Filing has been extended |

|

Important Update 1: The due date of Income Tax Return Filing (IT Returns) for FY 2018-19 has further been extended from 3oth September, 2020 to 30th November, 2020. Also, the Due date for Income Tax Return Filing for FY 2019-20 is also 30th November, 2020 for each category of taxpayers

Here are some frequently asked questions on ITR filing this year!

1. I have received salary income and interest on FDRs? Should I file my ITR?

–> Yes, you must file your ITR on or before 31st July 2018, if your total income exceeds Rs. 2.50 Lakh in year 2017-18. Know more about Tax Slabs for FY 2017-18 here.

2. I have a business, but I am not under audit. Should I still file my Income Tax Return?

–> Yes, if you are not under audit, you should file your ITR before this date. If you are covered under audit, your due date of filing is 30th September 2018.

3. I am a director of a private limited company, which is covered under tax audit. As director, when should I file my return?

–> Well, if you draw salary from private limited company as a director, you must file return before 31st July. However, due date of company return filing is 30th September 2018.

4. I am a designated partner in an LLP. I have not drawn any remuneration from LLP. Whether I am under any obligation to file an ITR?

–> If your total income does not exceed Rs. 2.50 Lakh in FY 2017-18, you need not file your ITR. However, it is in your interest that you should still file your ITR, which has many benefits such as easy bank loans, valid proof of income, faster visa processing etc.

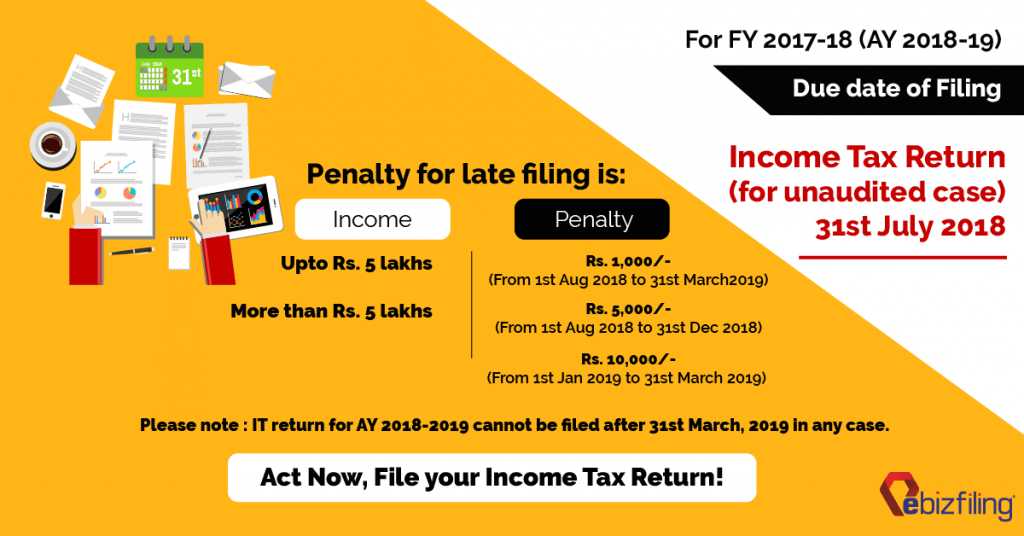

5. What if I file my ITR after the due date?

–> Among other consequences, below are major ones –

- Pay Late fees – You will be liable for a compulsory late fees. Visit here to understand how much amount you should pay as late fees.

- No losses carry forward – You cannot carry forward losses, if any, to the next year. This results in higher tax in subsequent year.

- Late refunds – If you are eligible for refunds, your refunds may be released late than usual.

- No Revision of Return – Return filed late, cannot be revised then.

6. As a salaried individual, what documents do you need to file my ITR?

–> We need scan copies of PAN, Aadhar, email ID, contact number and form 16. If you don’t have form 16, you need not worry. You can share the amount of salary you have received and the same will be appropriately disclosed in your Income tax return.

7. Do I need to submit any original documents to you for filing?

–> No, you only need to provide us scan copies. You may retain your original documents with you.

8. How can I reach you to file my ITR?

–> You can call us on 9643203209 or email on info@ebizfiling.com and our compliance manager will get in touch with you to smoothly file your ITR.

9. What are your charges for ITR Filing?

About Ebizfiling -

EbizFiling is a concept that emerged with the progressive and intellectual mindset of like-minded people. It aims at delivering the end-to-end corporate legal services 0f incorporation, compliance, advisory, and management consultancy services to clients in India and abroad in all the best possible ways.

To know more about our services and for a free consultation, get in touch with our team on info@ebizfiling.com or call 9643203209.

February 20, 2026 By Steffy A

Best Income Tax Software for Indian Taxpayers Introduction Filing Income Tax Returns (ITR) is a mandatory annual task for Indian taxpayers and often a stressful one. As per the Income Tax e-filing portal guidelines, taxpayers must submit their ITR […]

February 14, 2026 By Steffy A

Income Tax Rules 2026: Major Renumbering of Income Tax Forms Explained Introduction The Income Tax Rules 2026 mark one of the biggest structural changes in India’s tax compliance system in recent years. From April 1, 2026, taxpayers and professionals will […]

January 31, 2026 By Dhruvi D

Preparing and Filing Federal Tax Returns for US Taxpayers Introduction Filing federal tax returns is a yearly responsibility that many US taxpayers find stressful. The process often feels complicated because it involves multiple forms, deadlines, and rules that change […]