-

Articles - Company Law

-

July 14, 2025 By Team Ebizfiling

DPT 3 Form Filing, Frequently asked questions on ROC form DPT 3, the due date of Form DPT 3 and all you need to know about itDPT 3 Form Filing, Frequently asked questions on ROC form DPT 3, the due date of Form DPT 3 and all you need to know about it What is form DPT 3? DPT-3 is a return of Deposits or particulars […]

- Decoding Corporate Identity Number (CIN) Online

- Form DPT 3: Who Should File & Its Due Dates?

- Everything you need to know on Authorized Share Capital of a Company

- How to start Manufacturing Business in India?

-

-

Entrepreneurship

-

December 10, 2025 By Team Ebizfiling

Annual Compliance including exemptions / benefits for Small Companies in IndiaBenefits for Small Companies in India Introduction A small company enjoys several compliance benefits under the Companies Act in India. These advantages reduce the legal workload and allow founders to stay focused on growth. Small companies also save costs as […]

- Impact of Budget 2022 on MSME

- What is winding up? and Process to strike off a Company

- A guide on Performance and Credit Rating Scheme for MSME

- Differences Between A Pitch And A Business Plan

-

-

Company law

-

September 8, 2025 By Team Ebizfiling

India LLP Act 2008 and all you need to know about LLP in IndiaLLP Act 2008: Key Facts About LLPs in India 1. LLP Act 2008- Introduction The Lok Sabha passed the Limited Liability Partnership Bill on 13 December 2008 thereafter it received the assent of the President on 7 January 2009 and […]

- What are the Benefits of Name Reservation?

- एलएलपी विरुद्ध प्रायव्हेट लिमिटेड कंपनी – भारतातील व्यवसाय संरचनेच्या दोन महत्त्वपूर्ण प्रकारांमधील तुलना

- Tax Compliance and Statutory due dates for the month of April, 2021

- એલએલપીના ફાયદા શું છે?

-

-

Articles - Company Law

-

December 15, 2021 By Team Ebizfiling

Statutory due dates for Company Annual filing for Financial Year 2018-19A List of Statutory due dates for Company Annual Filing for Financial Year 2018-2019 Every Company is required to file the annual accounts and the annual returns within 30 days and 60 days respectively from the conclusion of the Annual […]

- Understanding Leave Policies in India: A Guide for Employers

- A process on “How to start a Toy Manufacturing Business in India?”

- Difference between Government and Public Limited Company

- How Can I launch a Business from Home?

-

-

Income tax

-

July 14, 2025 By Ishita Ramani

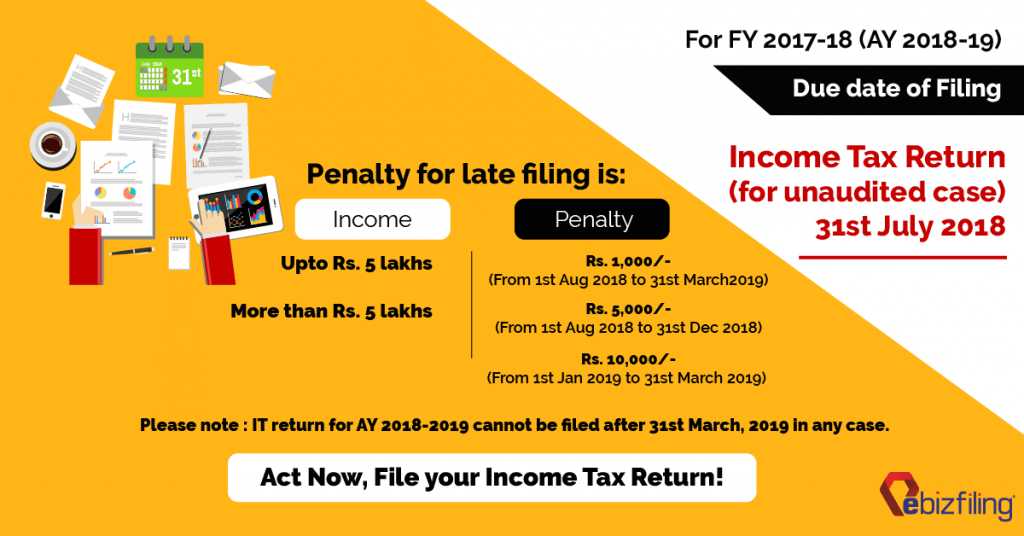

Compulsory Late filing fees on Income Tax Returns-Read to understand if this applies to youCompulsory Late filing fees on Income Tax Returns-Read to understand if this applies to you Important Update- Due date for Income Tax Return Filing has been extended The due date for filing Income tax Returns by taxpayers, Including their partners […]

- Income-Tax 1961 and 2025: New Income Tax Bill 2025 Highlights Side-by-Side

- Mistakes to Avoid during PF Withdrawal Process

- Tax Compliance and Statutory due dates for the month of June, 2021

- Tax System and the different types of taxes in the USA

-

-

Articles - Company Law

-

July 1, 2023 By Ishita Ramani

INC 20A Commencement of Business Certificate late fees explainedINC 20A Commencement of Business Certificate Introduction Form INC 20A is an important filing under the Companies Act, 2013. It serves as a declaration by newly incorporated companies to signify the commencement of their business operations. This form significantly ensures [...]

- FEMA Compliance in India

- What is Form MGT 14? – Types of Resolutions

- Re-engineering of LLP-Incorporation Related forms

- Appeal Procedure Under Companies Act, 2013

-

Popular Posts

-

June 23, 2025 By Dharti Popat - Articles - Entrepreneurship

All you need to know about Surrender of IEC LicenseMany times it happens when one starts a business, fulfils all the necessary compliances, takes all the necessary registration required to start a business. But during the course of business, it happens that one needs to close a business or […]

-

December 29, 2025 By Dharti Popat - Company law, GST, Income tax

Tax Compliance and Statutory due dates for the month of July, 2021Compliance Calendar for the month of July 2021 Finally, the world is opening and everything is getting back in line after a long deadlock because of the COVID 19 crisis. However, it will take some time for the businesses, entrepreneurs […]

-

December 29, 2025 By Dharti Popat - Company law, GST, Income tax

Tax Compliance and Statutory due dates for the month of September, 2021Compliance Calendar for the month of September 2021 It is crucial for every business, irrespective of the business structure to adhere to the statutory compliance and complete all the necessary filings before the due dates. It is important to stay […]

About Ebizfiling -