Author: Ishita

Ishita Ramani is a young woman entrepreneur and currently the Operations Director at Ebizfiling India Private Limited. In her entire career so far, she has led a team of 50+ professionals like CA, CS, MBAs and retired bankers. Apart from her individual experience on almost every facet of Indian Statutory Compliances, she has been instrumental in setting up operations at Ebizfiling.com! Read about her journey at- https://www.greatcompanies.in/post/ishita-ramani-operation-director-at-ebizfiling-india-pvt-ltd

Blogs by: Ishita

-

-

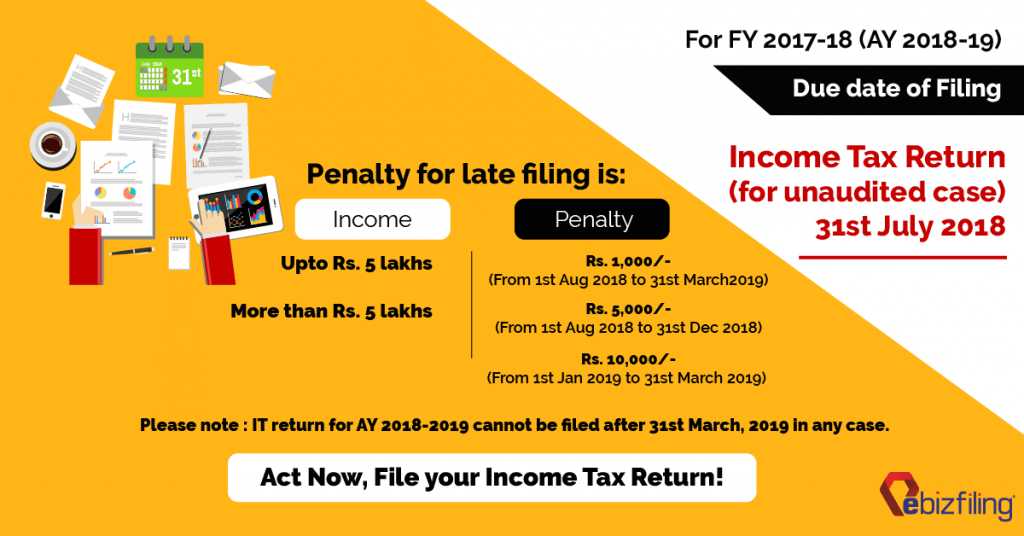

- Income tax

December 26, 2019 By Ishita Ramani

Compulsory Late filing fees on Income Tax Returns-Read to understand if this applies to youCompulsory Late filing fees on Income Tax Returns-Read to understand if this applies to you Important Update- Due date for Income Tax Return Filing has been extended The due date for filing Income tax Returns by taxpayers, Including their partners […]

-

-

-

- Articles - Company Law

December 24, 2019 By Ishita Ramani

INC 20A Commencement of Business Certificate late fees explainedINC 20A Commencement of Business Certificate Introduction Form INC 20A is an important filing under the Companies Act, 2013. It serves as a declaration by newly incorporated companies to signify the commencement of their business operations. This form significantly ensures [...]

-

-

-

- Income tax

September 16, 2019 By Ishita Ramani

Cost Inflation Index for Financial Year 2019-20Cost Inflation Index for Financial Year 2019-20 Cost inflation index calculates the estimated rise in the cost of goods and assets year-by-year as a result of inflation. It is fixed by the central government in its official gazette to […]

-

-

-

- Articles - GST

September 5, 2019 By Ishita Ramani

GST Rate on Electric Vehicles and Electric CarsGST Rate on Electric Vehicles and Electric Cars Originally electric vehicles (EV) and their key accessories such as EV chargers and EV charging stations featured a GST rate of 18%. But, the 36th GST Council meeting held on the 27th July 2019 […]

-

-

-

- Articles - GST

September 5, 2019 By Ishita Ramani

GST on Used/Old Cars in IndiaGST on used/Old Cars in India The Goods and Services Tax (GST) is a critical element in India’s taxation system, affecting various sectors, including the pre-owned vehicle market. The taxation framework for used cars has seen significant adjustments over the […]

-

-

-

- Articles - GST

September 5, 2019 By Ishita Ramani

GST Compensation Cess on CarsGST Compensation Cess on Cars What is Compensation Cess in GST Act? Compensation cess is a type of charge levied on certain goods in addition to the applicable GST and it was introduced as part of the GST Act. Compensation […]

-

-

-

- Articles - GST

September 4, 2019 By Ishita Ramani

Everything you need to know about GST on Commercial VehiclesGST on Commercial Vehicles. Commercial vehicles such as those designed for carrying passengers, goods or for agricultural use typically feature a GST on car in India and other vehicles are ranging from 12% to 28%. Before going through the GST […]

-

-

-

- Articles - GST

September 4, 2019 By Ishita Ramani

GST on car for personal useGST on car for personal use. Vehicles for personal use such as motor cars, motor vehicles and even bicycles feature GST ranging from 5% to 12%. GST rate applicable to vehicles is 5% on carriages (motorized/non-motorized) for use by disabled […]

-

-

-

- Articles - GST

September 4, 2019 By Ishita Ramani

GST on Cars in IndiaGST on Cars in India Introduction Goods and Services Tax (GST) currently applies to most goods and services in India including motor vehicles. GST on cars in India is applicable on multiple slab rates of 5%, 12%, 18%, and 28%. […]

-