-

Company law

-

March 9, 2024 By Dharti Popat

Statutory Due dates for OPC Annual Filing for FY 2022-23Important Statutory Due dates for OPC Annual Filing for FY 2022-23 A One Person Company (OPC) is a company that has only one member. Compared to other company types such as Private Limited or Limited Liability Partnership, OPCs have lower […]

- Update or Change the TAN Application

- LLP Strike Off: When Filing Requirements Are Defaulted

- FAQs on the Non-Disclosure Agreement

- TAN पंजीकरण की प्रक्रिया और लाभ

-

-

Company law

-

March 9, 2024 By Siddhi Jain

Important Due Dates For OPC Annual Filing For FY 2023-24Important Statutory Due Dates For OPC Annual Filing For FY 2023-24 An OPC, or One Person Company, is a company with a single member. Unlike Private Limited or Limited Liability Partnerships, OPCs have fewer compliance requirements. However, it is crucial […]

- Process to Change the LLP Agreement

- FAQs on Name Reservation of a Company

- Difference Between FCRA Registration & Accreditation

- भारत में गैर सरकारी संगठनों के लिए धन कैसे प्राप्त करें?

-

-

Company law

-

March 9, 2024 By Dharti Popat

Important Statutory due dates for Company annual filing for FY 2022-23Important Statutory Due dates for Company Annual Filing for FY 2022-23 At the beginning of every financial year, companies registered in India are reminded to take note of all the important due dates for Company Annual Filing. This applies to […]

- Ways to apply for a Business Loan with bad credit

- Article of Association for Nidhi Company Registration

- Setting up an Indian Subsidiary is not as difficult as you think

- Foreign Exchange Management Act – FEMA Applicability, Objectives and Penalty

-

-

Limited Liability Partnership

-

March 9, 2024 By Siddhi Jain

Important Statutory Due dates for LLP Annual Filing for FY 2023-24Important Statutory Due dates for LLP Annual Filing for FY 2023-2024 Compliance with regulations is essential for registered businesses in India. A Limited Liability Partnership (LLP) is a business structure that requires a minimum of two members and has no […]

- What are the key differences between LLP Strike-off & Winding up?

- Partner and Designated Partner in an LLP: What is the Difference?

- How to Avoid LLP Strike-Off When No Tax Return is Filed?

- Process to Change the LLP Agreement

-

-

Income tax

-

March 8, 2024 By Siddhi Jain

TDS on Prize, Betting, Lottery WiningSection 194B of Income Tax Act, 1961: Prize, Betting, Lottery Winning Tax Introduction In the present day, there is a wide range of game shows, including the popular Kaun Banega Crorepati (KBC) and Fear Factor, as well as reality shows […]

- Procedure to file ESI Nil Return on ESIC Portal

- Foreign Tax Credit: How to claim tax credit on foreign income?

- Overview of Section 194M of Income Tax Act, 1961

- Compliance Calendar for the Month of December, 2022

-

-

Company law

-

March 5, 2024 By Siddhi Jain

Transmission of Shares upon Shareholder’s deathProcess of Transmission of Shares Upon the Death of a Shareholder Introduction The transmission of shares upon a shareholder’s death is an important aspect of corporate governance and estate planning. When a shareholder passes away, their shares need to be […]

- FAQ’s Shifting of forms from MCA V-2 to MCA V-3 Portal

- Some important compliances for NGOs in India

- The Pros and Cons of Online vs. Traditional Business License Application

- A guide on Form DIR-5 for Surrendering of DIN (Director Identification Number)

-

Popular Posts

-

June 19, 2023 By Pallavi Dadhich - Articles, Company law

What is the Role of Corporate Governance in Charge creation by Company?All you need to know about the Role of Corporate Governance in Charge creation by Company Introduction Charge creation is a vital aspect of corporate governance that plays a significant role in the functioning of a company. It refers to […]

-

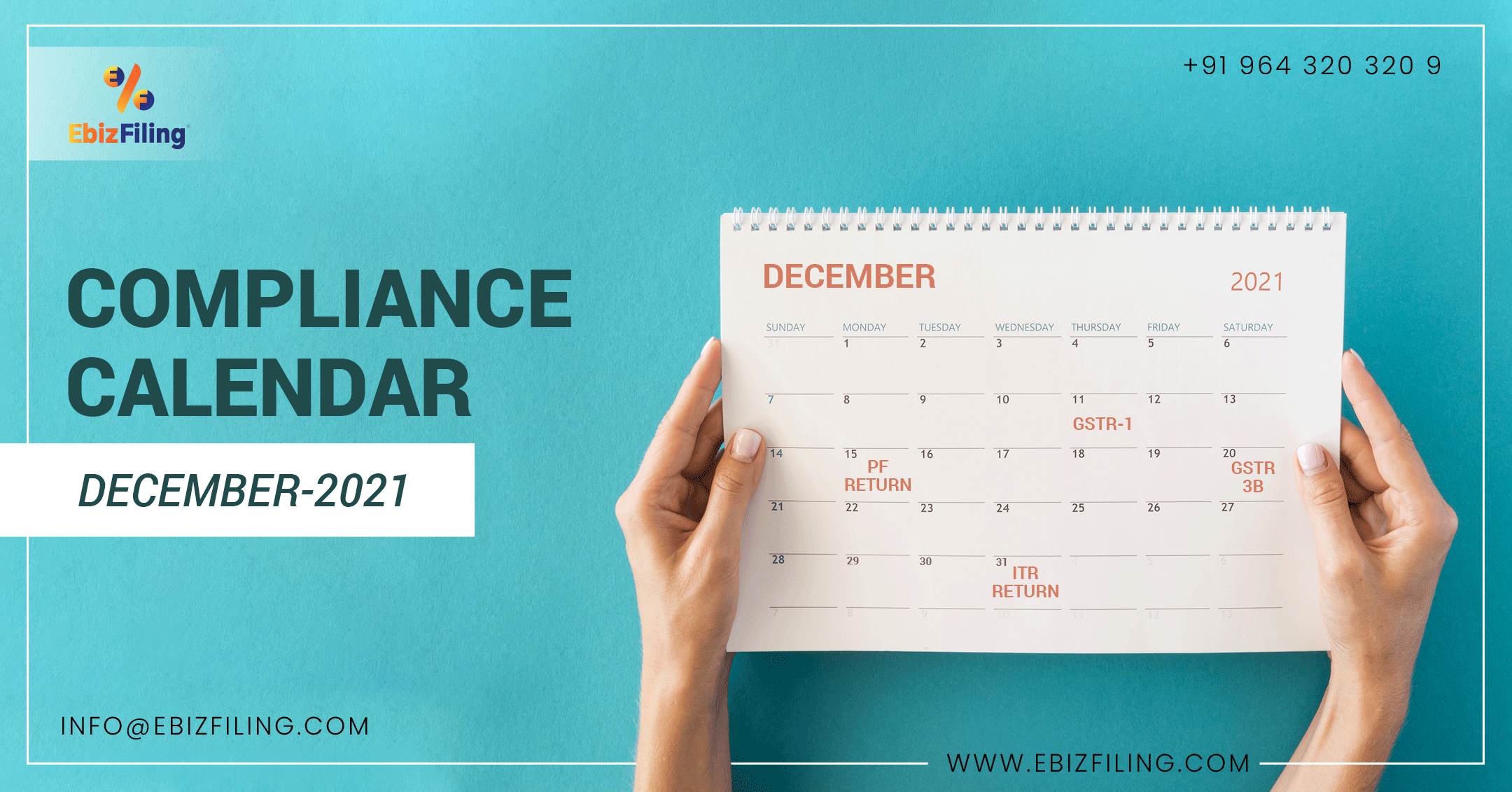

December 30, 2021 By Dharti Popat - Company law, GST, Income tax

Tax Compliance and Statutory due dates for the month of December, 2021Compliance Calendar for the month of December 2021 Starting, owning, or doing a business in India comes with important compliance that a business irrespective of its structure, has to adhere to during a financial year. Be it filing of Income […]

-

October 30, 2021 By Dharti Popat - Articles - Company Law, Articles - GST, Articles - Income Tax, One Person Company

Tax Compliance and Statutory due dates for the month of November, 2021Compliance Calendar for the month of November 2021 Statutory Compliance are part and parcel of a Business. Whatever the business structure be, it is important to comply with all the necessary filings before the due dates. Starting from filing Income […]

About Ebizfiling -